Even while the overall automotive market continued falling — in 2022 it was down 4% compared to 2021 — Europe’s passenger plugin electric car market had a historic month in December, with 413,500 registrations. That is a massive 46% improvement over the previous month of November, which had already beaten the December 2020 record of 282,000 units.

This amazing result, no doubt influenced by the reduction of incentives in a number of markets, allowed the December plugin vehicle share to surge to a record 38%. There was 25% full electric vehicle (BEV) share alone. The 2022 numbers rose above 2.6 million plugin vehicle sales, with the 2022 PEV share ending at 23% (14% BEV). That’s a small jump from the 19% share (10% for BEVs alone) of 2021, but a significant departure from the 11% of 2020 and a far cry from the 3.6% of 2019. I think we can expect the 2023 plugin share to end around (above?) 30%.

Looking more closely at the European electric car market in December, highlighting the massive surge in registrations, 18 of the 20 models on the December best seller list hit record results! True, much of this peak had to do with the aforementioned reduction in incentives, and most of the performances had more to do with the OEM capability to increase production to meet demand than anything else, but still … December could give a sneak peak of what will happen throughout 2023. From now on, if OEMs want to grow their sales, they need to have not only heavily electrified lineups, but also production capability to meet demand. It’s do or die. So, let the games begin….

In December, the BEV market had a record month (275,277 registrations, +51% YoY), beating the previous record by a wide margin (51% more, to be precise). Even PHEVs had a positive month (+40% YoY), beating their own record from March 2021. But with the end of incentives for PHEVs in a number of markets in 2023, expect plugin hybrids to experience a serious hangover in 2023.

So, while plugin hybrids ended 2021 and 2020 with the same share of the plugin market (46%), 2022 saw that number reduced significantly, to 39%. Expect PHEVs to drop even further in 2023, to some 30% share, or maybe even less. It could even be the case that we will see a 100% BEV top 20 in 2023! Is it asking too much?

In December, Tesla won #1 and #2, followed by two Volkswagen models. A prelude of how 2023 will be?

Top Selling Electric Vehicles in Europe — December

Looking at December’s top 5 models in the electric car market:

#1 Tesla Model Y — The 2022 best selling EV in Europe had a record 32,442 deliveries, the highest monthly result for a model ever — not only for any Tesla model, but for any EV ever in Europe! That allowed it to be the best selling model in the overall market in December! And having been the best seller also in September and November, this was its 3rd top spot in the overall market in the last four months!!! Can the midsized crossover win the overall best seller title in 2023? Well, let’s not get ahead of ourselves. Yes, the Tesla Model Y won the title on three occasions during 2022, but we all know Tesla models still have significant peaks and valleys. Proof of that is that despite those three wins, the Model Y was only #13 in the full year. A top 10 spot in the overall market seems certain, but a top 5 position? Hmmm… Something to discuss over the next year.

Unlike the Model 3’s focus on the bigger European countries, the crossover’s main markets have a more diverse tone, with the UK taking the lion’s share of the deliveries (10,664 units) but other markets also having significant volumes. Other top markets include Germany (7,382 units), Norway (4,524 units), France (2,493), the Netherlands (2,296), and Sweden (1,091 units).

#2 Tesla Model 3 — Tesla’s sedan had 20,335 deliveries in December, its best score in 2022. With Model 3 deliveries dropping a significant 23% in 2022 compared to the previous year, in no small part due to internal competition from the Model Y, one wonders if the recent price drops will be enough to stop the sales bleed. Or will only a significant refresh kickstart the sedan’s sales again. Q2 2023 should start to answer these questions. Regarding December, the sedan was focused on the three biggest EV markets in Europe — the UK (5,700 deliveries), Germany (9,566 deliveries), and France (2,671 deliveries). Switzerland (330 deliveries) was a distant 4th. Expect the Model 3 to continue competing for a podium position throughout 2023, but this time, expect stronger competition from the VW ID.4 and ID.3, with the Fiat 500e continuing to be on the lookout as well.

#3 Volkswagen ID.4 — The star of Volkswagen Group ended the month on a high note again, getting 13,685 registrations. That’s the crossover’s best result ever in Europe and its first five-digit score. With its production constraints now surpassed, the USA allocation being produced locally, and Emden production ramping up, expect higher production output for the European ID.4 during 2023. Volkswagen is hoping to reach a 10,000 unit/month average, a necessary threshold to cross in order for the crossover to remain relevant globally. Those 5-digit performances in Europe will be needed to add to the 5-digit(ish) Chinese performances. It could then reach between 200,000 and 300,000 deliveries in 2023. Regarding December deliveries, the Volkswagen EV had its best score in Germany (5,193 units) and Norway (2,075 units), followed by Sweden (1,721 units) and the Netherlands (752 units).

#4 Volkswagen ID.3 — The EV that was supposed to follow in the footsteps of the best selling Volkswagen Golf is back on track, with the ID.3 scoring its 2nd best performance ever, 11,561 registrations in December. That is only behind its score in the super-inflated month of December 2020, when it (pre-)registered 28,110 units. The German OEM’s production constraints are easing, and Volkswagen now has enough room to increase the ID.3’s production rate. For a while, it seems that the ID.3’s production was being strangled in favor of other, more expensive (and profitable) members of the MEB family. Regarding December deliveries, the compact Volkswagen EV had its best scores in Germany (6,865 registrations) and the UK (1,130 registrations), followed by France (971 registrations).

#5 Ford Kuga PHEV — The Euro-spec version of the Ford Escape PHEV had another record month in November, with 10,726 units registered. Ford has milked its crossover to the last drop before the sunset of PHEV incentives in Germany. This is visible when looking at December deliveries, with the crossover having by far its best score ever in Germany (6,778 registrations). This market alone is responsible for 63% of the model’s deliveries in December. The next best markets were the UK (1,150 registrations) and Spain (644 registrations).

Looking at the remaining December best sellers, with everyone else getting record results, one can only highlight a few of them. As such, here goes:

The Dacia Spring was #6, with 9,694 registrations. The little crossover seems ready to cross into five-digit scores in 2023. The classy #8 Renault Megane EV continued to ramp up deliveries, reaching 8,084 registrations in December, its 4th record score in a row. It looks like the French hatchback is also ready to jump into the five-digit scores club and become a regular in the top 5. The same could be said about the #9 Volvo XC40 EV, which had 7,732 registrations in December (and with 3,910 registrations of the PHEV version added in, the Swede would be 5th in the market at 11,642 units). This confirms Volvo’s newfound faith in BEVs. With the recent spec update, expect the Volvo SUV to rise a few more positions in 2023.

The highlight in the second half of the table is the rise and rise of the #11 VW ID.5. Its 7,277-unit total was its seventh record in a row! The sporty crossover was one of the most profitable models of the MEB platform. Do not expect big production constraints for it, even if at the cost of production cuts in less profitable models, like that of the #10 Cupra Born….

A mention goes out to the Audi e-tron, with the veteran model scoring a record result (5,665 units) in what was probably its last production month — just before the Q8 e-tron (aka new name of the refreshed e-tron) lands. And that refresh is coming at the right time, because the BMW iX is starting to make itself noticed. The big Beemer scored 5,118 registrations in December, allowing it to be #20 in December.

Still on the topic of the top 20, the BMW i4 is ready to replace its 3 Series PHEV sibling in the 2023 table. It will compete with the Ioniq 5 (and Ioniq 6?) as well as with the recently refreshed Polestar 2 for the best selling non-Tesla midsizer title.

In the PHEV category, there is really no competition for the Ford Kuga PHEV. The only other plugin hybrids showing up in the table were the #16 Mitsubishi Eclipse Cross PHEV and #19 Lynk & Co 01 PHEV. The Chinese model is yet to land in a number of markets in Europe, so expect the compact SUV to be less affected by the end of PHEV incentives. It could be a strong contender for the 2023 PHEV best seller title, along with the new Mercedes GLC PHEV.

Outside the top 20, there is a lot to talk about, especially in the compact category. The BYD Atto 3 (aka Euro-spec Yuan Plus) is starting to ramp up deliveries, having reached 1,649 registrations in December, while the MG 4 had 3,442 registrations, with the stylish hatchback scoring its third record result. That actually allowed it to become the best selling electric MG. At this pace, expect it to reach the top 20 soon.

The BMW iX1 compact crossover landed in December, with 1,593 registrations, and expect it to ramp up during 2023. The new EV hopes to be the third top 20 Musketeer in BMW’s lineup this year.

But before that, the compact crossover will have to surpass its arch-rival Mercedes EQA. That model reached a record 3,911 registrations. Another model from the three-pointed-star lineup, the EQE sedan, scored a record 1,415 registrations. Not only is it miles behind the category leaders (the Audi e-tron and BMW iX), but its sales are also less than half of what the six-figure priced Porsche Taycan got in the same period. Mercedes is known for its glacial pace when ramping up production, but the EQE career is one of the most critical points in the current Mercedes EV lineup — after all, it is the EV counterpart to the highly profitable E-Class — and if Mercedes screws this one up, things can get messy in the future. To be continued. …

Top Selling Electric Vehicles in Europe — 2022

Looking at the 2021 ranking, the Tesla Model Y won its first best seller title, dropping its Tesla Model 3 sedan sibling to the runner-up position. So, again, Tesla won 1st and 2nd place in Europe.

Expect the Model Y to win this title again in 2023, probably with a better score than in 2022. However, the #2 position of the Model 3 could be in real danger in the new year. Not only does the Model 3 need to find a way to stop the sales bleed (it was down 36% in 2022), but it will also have to deal with a rising VW ID.4, which is looking for a 100,000+ result by the end of 2023. And that is in the case that it stops losing sales. If it doesn’t, even the VW ID.3 (due for a refresh in 2023) and Fiat 500e (now ready to benefit from the sting of the Abarth version) could overcome the Tesla sedan.

With the mainstream best sellers being B-segment/subcompacts (#1 Peugeot 208, #2 Dacia Sandero), A-segment/city cars (#5 Fiat 500), and C-segment/compacts (#3 VW T-Roc, #4 VW Golf), in order for the plugin market to really replace the ICEV top sellers, the EV top spots need to have more competitively-priced, small EVs.

By the end of Q1, we should have a better idea of how things will develop, but until then, let’s go back to the final stage of the 2022 race.

The VW ID.4 profited from a particularly good end of the year to displace the Fiat 500e from the podium, allowing the German crossover to take the 2022 bronze medal.

Also benefitting from strong year-ends, the Ford Kuga PHEV was up to 5th, while the VW ID.3 jumped two positions into #6. Still on the topic of the Volkswagen Group mothership, three more models were on the rise. The stylish Audi Q4 e-tron reached #10, the flagship Audi e-tron ended in #16, and the sporty Cupra Born joined the table in #19. This means there were six Volkswagen Group models on the final 2022 top 20 table, five of them coming from the MEB platform.

The Renault–Nissan–Mitsubishi also had reasons to celebrate, with the value-for-money Dacia Spring rising to #8 while the Renault Megane EV joined the table in #18. Expect this last one to be one of the surprises of 2023, with the hatchback crossover looking for a top 10 (top 5?) position this year.

In the PHEV League, the Ford Kuga PHEV took the category title without any effort, but it should have a harder time retaining the title this year, especially from the hands of the new Mercedes GLC PHEV.

Looking at the size categories, the new Fiat 500e took the city car title, replicating the Italian model’s success in the mainstream city car category. Although, the Dacia Spring has already demonstrated that, with different arguments, it can also become a serious candidate in the city EV category. Expect another interesting race between these two in 2023.

In the size above, the prize this time went to the Peugeot e-208, with the attractive hatchback finally beating the Renault Zoe, which is soldiering on despite the wrinkles until the arrival of the future Renault 5.

In the compact category, the VW ID.4 succeeded the VW ID.3 on the throne and should continue there throughout 2023.

In the categories above, the Teslas Model Y and Model 3 had no real competition among midsizers, while in the full size category, the Audi e-tron again won the title — but the future Audi Q8 e-tron will have a tough cookie to deal with in 2023, as the BMW iX is closing in. Will we see a close race here?

Top Brands for Electric Vehicle Sales in Europe — 2022

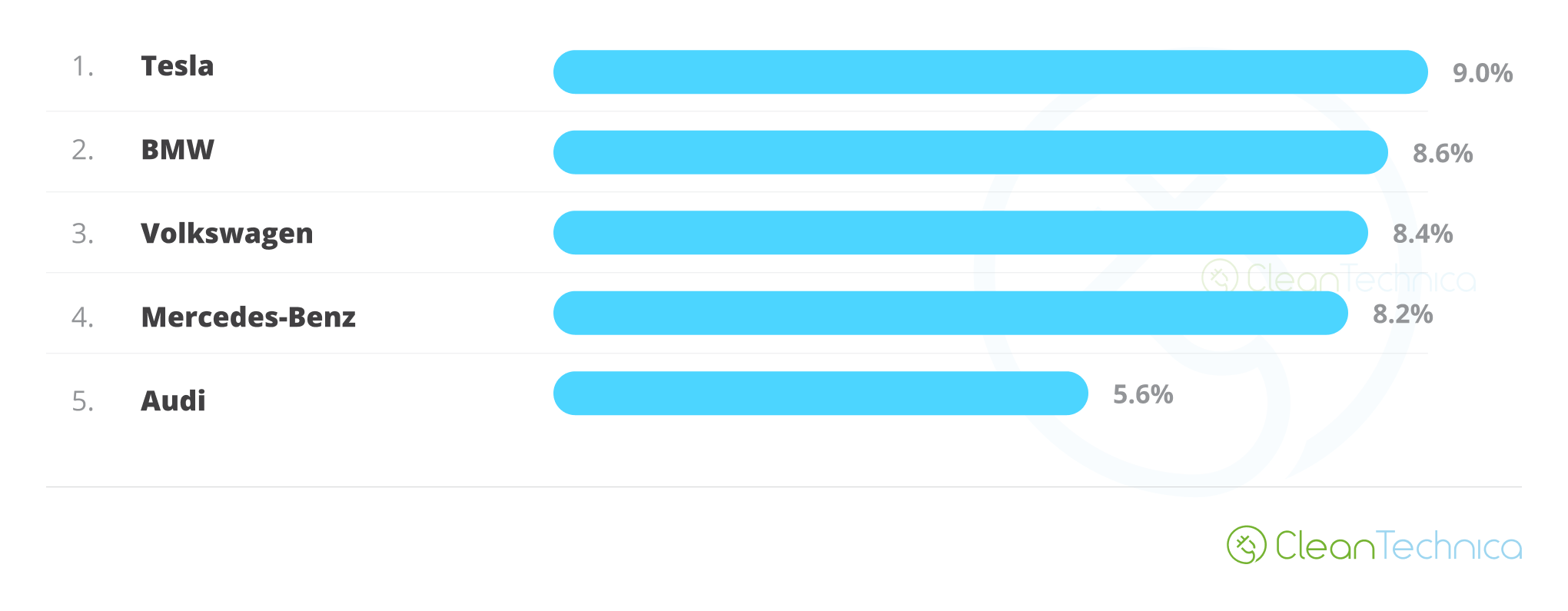

In the passenger vehicle brand ranking, a major surprise came in the last stage of the race: Tesla, which was still 4th in October, jumped into the leadership spot and became the best selling brand in 2022!

Having increased its share by 0.9% in December, Tesla jumped to 9% share, surpassing BMW (8.6%, down 0.2%) and Mercedes (8.2%, down 0.2%), in just one month. It jumped from 3rd to first in just one month!

Volkswagen (8.4% share, up from 8%) also benefitted from a strong end of year, climbing one position to 3rd. Despite losing the brand title to Tesla, it still remained close and all signs indicate that 2023 will see a close race between Tesla and Volkswagen. Bring on the popcorn, because this will be fun!

Audi (5.6%) profited from a slow month from Kia (5.4%, down from 5.7%) and ended the year in 5th, while a rising Volvo (5.3%, up from 5.1%) surpassed Peugeot (4.9%, down from 5.2%) and ended in 7th. It even came close to surpassing #6 Kia.

Top Auto Groups/Alliances for Electric Vehicle Sales in Europe — 2022

Finally, looking at the OEM level, #1 Volkswagen Group (20.6%, up from 20.2%) had no problem winning the electric car market’s top spot again. Stellantis (14.6%, down from 15.2%) repeated its runner-up finish with some degree of comfort.

Behind these two, things were more interesting, with BMW Group (10.5%, down from 10.7%) surpassing Hyundai–Kia (10.1%, down from 10.7%) in the last days of the year and winning the bronze medal. (Interestingly, BMW had done the same trick last year — at that time, to Daimler.)

The 5th position stayed in the hands of Mercedes-Benz (9%, down from 9.3%), with the German OEM ending some 2,000 units ahead of rising Tesla (9%).

With the #7 Renault–Nissan Alliance (8.7%) profiting from strong results across the board (Renault Megane EV, Dacia Spring…), the French-Japanese OEM is also looking for a top 5 position in 2023, and even the rising #8 Geely–Volvo (7,6%) could also join the race for the 5th position…

Source: Link

@José Pontes, @CleanTechnica