In recent reports, a sharp decline of 43.9% in battery-electric vehicle (BEV) registrations was highlighted within the European Union (EU) for August 2024 compared to the same month in the previous year. At face value, this suggests a significant setback for the electric vehicle (EV) market. However, a deeper analysis reveals that this decline is largely influenced by an extraordinary event in Germany during August 2023, which artificially inflated BEV sales that month.

This article aims to provide a more nuanced analysis of the BEV market by examining how different Member States contributed to the change in BEV sales and comparing the performance of various powertrains to debunk the narrative of a declining EV market.

Understanding the Anomaly in Germany

In August 2023, Germany experienced a substantial surge in BEV registrations due to the imminent expiration of subsidies for company car purchases. This policy change prompted a rush to register BEVs before the subsidies ended, resulting in an unusually high sales figure for that month. Consequently, when comparing August 2024 sales to the inflated numbers from August 2023, the year-over-year decline appears exaggerated.

Contributions of Member States to the Change in BEV Sales

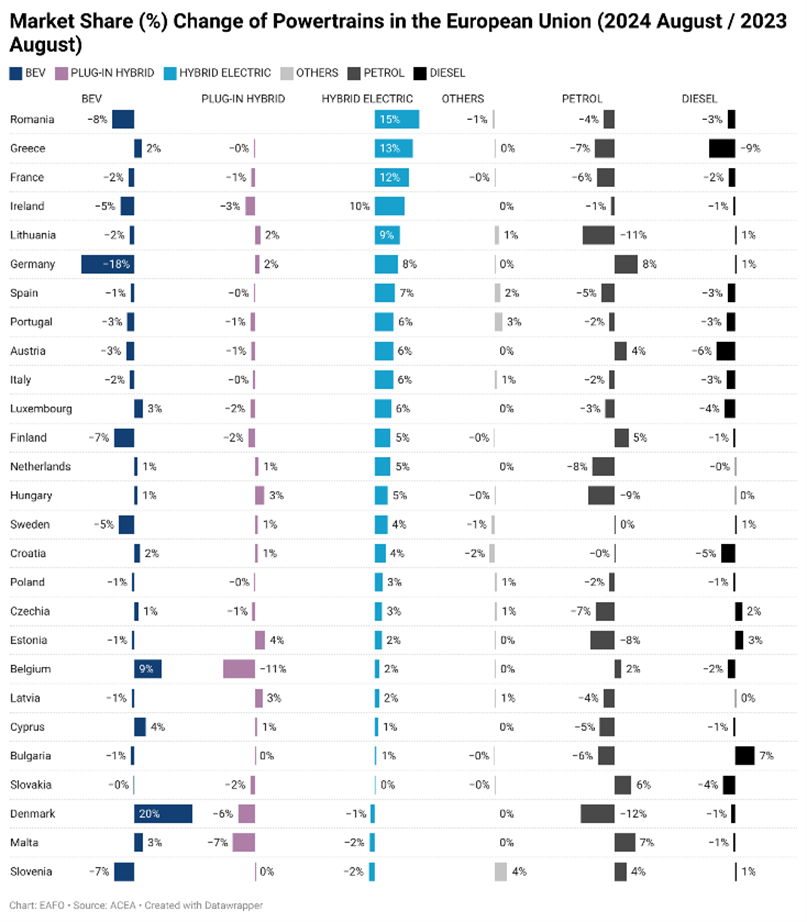

By decomposing the overall decline in BEV sales, we can identify how each Member State contributed to the change between August 2023 and August 2024.

Figure 1: Contributions of Member States to the Change in BEV Sales between August 2023 and August 2024

The waterfall chart in Figure 1 illustrates that Germany is the primary contributor to the overall decline in BEV registrations. When isolating Germany's impact, the decline in BEV sales across the rest of the EU is significantly less pronounced.

Key Observations:

- Germany: Recorded a decrease of 59,625 BEV registrations, a direct result of the subsidy expiration in August 2023.

- France: Experienced a decline of 6,514 BEV registrations compared to the previous year, which happened in the context of a declining automotive market, with the weakest month of sales since August 2014. Additionally, in France, most other powertrains than BEVs, had steeper drops, like PHEVs (-35%), Petrol (-37%) and Diesel (-43%), with the only powertrain with positive numbers being HEVs, with a 13% growth rate.

- Sweden: Saw a decrease of 2,994 units.

- Italy, Romania, Finland and Spain also contributed to the decline with reductions ranging from -1,660 to -887 units.

- Positive Contributors: Some countries increased their BEV sales:

- Denmark: Increased by 2,278 units.

- Belgium: Increased by 786 units.

- Netherlands: Increased by 271 units.

- Czechia: Increased by 184 units.

- Greece, Croatia, Hungary, Cyprus, and Malta also showed increases.

These figures demonstrate that while some countries faced declines, others continued to grow their BEV markets, highlighting the heterogeneous nature of the EU automotive landscape.

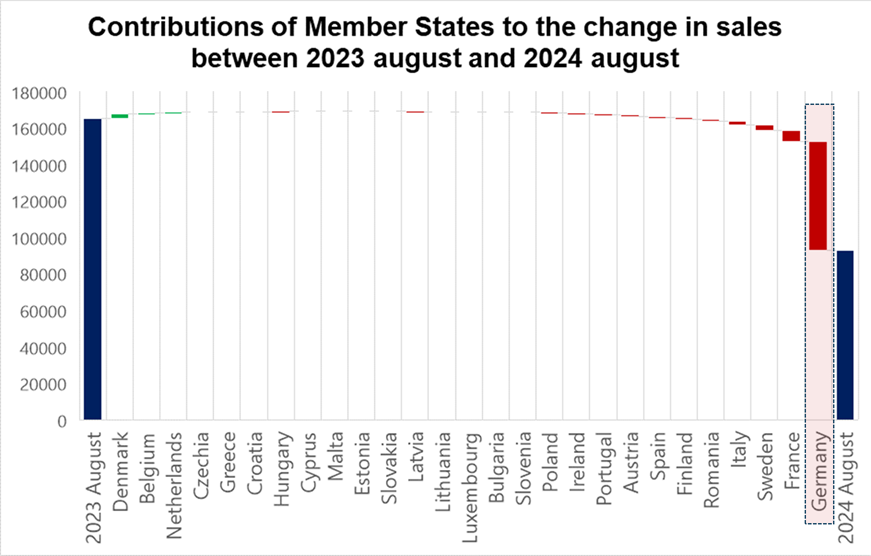

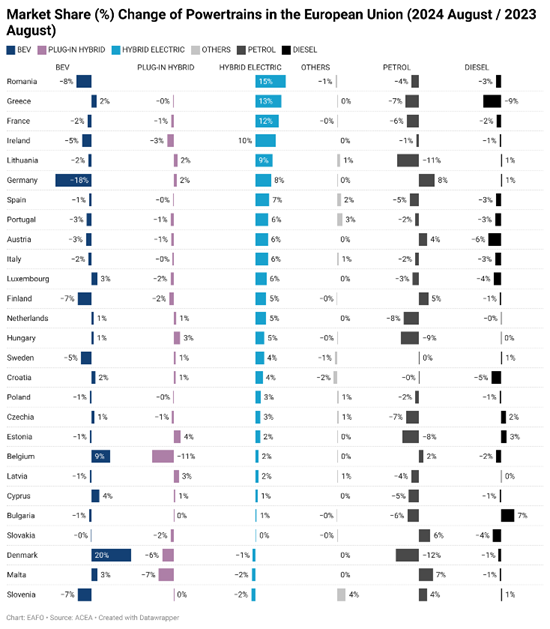

Market Share Changes Across Powertrains

To further understand the market dynamics, we analyse the market share percentage changes of different powertrains in the EU between August 2023 and August 2024.

Figure 2: Market Share (%) Change of Powertrains in the European Union (August 2024 vs. August 2023)

Overall Market Trends

In addition to powertrain-specific trends, it's essential to consider the overall automotive market performance across the EU. The total number of new car registrations declined in several Member States between August 2023 and August 2024.

Total New Car Registrations:

Observations:

- The overall EU automotive market experienced a decline of 18.3% in new car registrations.

- Major markets like Germany and France saw significant declines of 27.8% and 24.3%, respectively.

- Some countries, such as Cyprus and Malta saw increases in total car registrations, indicating varied market conditions across the EU.

- The overall market decline provides context for the reductions seen in BEV sales, suggesting that the decreases are part of a broader market trend rather than an isolated issue with electric vehicles.

Market Share Shifts

Looking at the average market share changes across powertrains, it's evident that traditional internal combustion engine vehicles are losing ground, while electrified vehicles, particularly hybrid electrics, are gaining:

- Petrol Vehicles: Average market share decreased by 2.7%, making them the biggest losers in the market shift.

- Diesel Vehicles: Also faced a significant decline with a 1.3% reduction in market share.

- Hybrid Electric Vehicles (HEVs): Enjoyed a substantial growth with a 5.0% increase in market share, highlighting consumer interest in more fuel-efficient and environmentally friendly options.

This data underscores a market transition toward electrification, even amid overall sales declines.

Evaluating the Narrative of a Declining EV Market

Recent report`s portrayal of a declining BEV market does not account for the exceptional circumstances in Germany. By considering the broader market context and analysing the average market share changes:

- Hybrid Growth: The significant increase in HEV market share (+5.0%) indicates a strong consumer shift toward electrified vehicles.

- Market Dynamics: The overall market decline affects all powertrains. When adjusted for anomalies, BEVs and other electrified vehicles show resilience and continued consumer interest.

- Policy Influence: The substantial drop in Germany underscores the impact of government policies on vehicle sales, emphasizing the need to consider policy contexts in market analyses.

Conclusion

A thorough analysis of BEV sales in the European Union indicates that the apparent sharp decline in August 2024 is largely the result of an extraordinary event in Germany during August 2023. The expiration of subsidies in Germany led to an artificial surge in BEV registrations that month, creating a misleading baseline for year-over-year comparisons. Additionally, August was the first full month of increased tariffs for the Made-in-China BEVs, affecting the registrations of BEV models coming from that country, a limitation that is not applicable to the remaining powertrains. When these anomalies, and not other important dynamics of the European car market are accounted for, and the overall market downturn is considered, the car market demonstrates resilience and a continued progression toward electrification.

Petrol and diesel vehicles are experiencing the most significant losses in market share, highlighting a diminishing consumer preference for traditional internal combustion engines. In contrast, hybrid electric vehicles are gaining substantial traction, reflecting a growing consumer inclination toward electrified powertrains despite short-term fluctuations caused by policy changes and market conditions.

These insights underscore the importance of considering anomalies and broader market trends in automotive analyses and reports. By doing so, stakeholders can obtain an accurate representation of the industry, enabling informed decision-making that supports the transition to sustainable transportation. A nuanced understanding of market dynamics ensures that policies and business strategies are aligned with the evolving preferences of consumers and the overarching goal of environmental sustainability.

Source: ACEA (2024) Link