Some 197,000 plugin vehicles were registered in April in Europe — which is +25% year over year (YoY). Unfortunately, the overall market grew almost as fast, +16%, getting close to 1 million sales as it is finally recovering from a couple of bad years.

Last month’s plugin vehicle share of the overall European auto market was 21% (13% full electrics/BEVs). That result kept the 2023 plugin vehicle share at 21% (13% for BEVs alone) as well.

BEVs (+50% YoY) kept gaining momentum in April, while PHEVs (-4%) were back in the red. These performances allowed pure electrics to represent 64% of plugin registrations last month, with the YTD share now at 65%.

The big highlight of the month was the Tesla Model Y leading the overall market, but let’s look closer at April’s plugin top 5:

#1 Tesla Model Y — For the 6th month in a row, Tesla’s crossover was the best selling EV in Europe. In April, the midsizer had 10,778 registrations, an amazing result for a first month of the quarter — that no doubt benefited from the recent price cuts and also from the fact that the Model Y is one of the few EVs that has a balanced supply-and-demand ratio, allowing for quick delivery for anyone interested in buying one. This year could be considered “Peak Model Y” in Europe. The midsize crossover should continue to post similar results in the coming quarters in Europe, but do not expect sales to increase significantly over current volumes, as the Model Y has already reached the market’s natural limits*. Regarding last month’s performance, the Model Y’s biggest European markets included the UK (1,550 units), France (1,333 units), and Germany (1,636 units).

(* The point where no matter how compelling the vehicle is, because there are already several in the neighborhood, people just go for something else. Some people have called this in the past the “Toyota Camry effect.” Adding to this, we are walking into a maturing market, where people are spoiled with different choices. Even if the alternatives are more expensive and/or consumers have to wait, some people go elsewhere because they have different needs or just want something more exclusive.)

#2 VW ID.4 — The Volkswagen crossover jumped to the runner-up spot in April thanks to 6,682 registrations. With increased production availability, thanks to local USA production and the start of production in Emden adding additional volume to the original plant in Zwickau, the ID.4 now has enough firepower to compete for the #2 spot in 2023, looking to improve on the #3 spot it scored last year. Will the crossover get there? One thing is certain: last year’s runner-up, the Tesla Model 3, no longer seems unbeatable. Regarding the ID.4’s April performance, its main markets were its home market of Germany (2,203 registrations), followed from a distance by the UK (620 registrations), Norway (602 registrations), and Sweden (661 registrations).

#3 Volvo XC40 (BEV+PHEV) — The compact Swede is a sure value in the EV arena, and with the BEV version being the main driver of growth (4,037 registrations), Volvo’s popular SUV ended the month on the podium. The XC40 doesn’t really stand out on any item in particular, but it also doesn’t have weak points, making it a no-nonsense option that contributes to its continued success. In April, it had 6,004 registrations, with the XC40 sales distribution being even across several medium-sized markets, like Sweden (793 registrations) and the Netherlands (699 registrations). The UK was also a big receptor of sales (876 registrations).

#4 VW ID.3 — After a tough 2022, the compact Volkswagen has come back to life, even earning another top 5 presence in April thanks to 5,927 registrations. With the restyling giving it a slightly more purposeful look, losing a bit of its “happy puppy” look while getting better interior materials, the German hatchback is looking to replicate the VW Golf’s decades-old recipe for success: Being not especially good or bad at anything, and having a design that doesn’t scare anyone. It now only needs to have a pragmatic, no-nonsense interior like the VW Golf of the good ol’ days. … But I digress. Back to the ID.3’s April performance. Its main markets were its home market of Germany (2,050 registrations) and the UK (1,115 registrations), with the remaining markets ending at some distance, like the case of France (439 registrations) and Norway (391 registrations).

#5 Skoda Enyaq — Without reaching the sales levels of its superior in command VW ID.4, the Skoda Enyaq was nevertheless the Surprise of Month. With 5,101 sales, the best value for money model from the MEB-platform is currently in recovery mode after a slow start to the year. Germany was by far its largest market, with 1,405 registrations, followed by the UK (555 registrations), Norway (454 registrations), Sweden (346 registrations), and Switzerland (342 registrations). This last result might surprise some, given that Switzerland might not be a country associated with value for money models, but the fact is that in the current overall 2023 top 5 in Switzerland (#1 Tesla Model Y, #2 Audi Q3, #3 Skoda Karoq, #4 Skoda Octavia, and #5 BMW X1), there are two Skodas, and the Enyaq is 8th overall. So, 3 Skodas are in the Swiss top 8! So, yes, Skoda is a popular brand in Switzerland.

Looking at the rest of the April table, let’s look at a few highlights. The #7 spot of the MG 4 was one such highlight, with the striking hatchback proving that it is a force to be reckoned. Additionally, the BMW i4 was #14, with 3,061 registrations, making it the best selling model from BMW Group. The last spots of the top 20 had the Polestar 2 and Mercedes EQA reaching the table, in #17 and #20, respectively. These two are also trying to join the YTD table.

Below the top 20, we had several models with positive performances, like the recently introduced BMW iX1 crossover, with 2,361 registrations. Expect the compact Bimmer to join the table soon. Still on BMW Group, the Mini Cooper EV had 2,281 registrations. Kia saw its EV6 reach 2,342 deliveries, beating its Hyundai Ioniq 5 cousin by just 12 units (2,330 registrations).

Finally, despite having only two representatives on the table, Stellantis had three other models getting significant scores, like the Peugeot 2008 electric crossover (2,058 registrations) and Opel’s BEVs, the Corsa EV (2,207 registrations) and the Mokka EV (2,116 registrations).

Looking at the category’s overall leaders, and focusing only on the C (compact) and D (midsize) segments/categories, in the latter, we can see that the Tesla Model Y continues to rule supreme, even in an off-peak month. It had 10,553 registrations. The Model Y was followed by the Mercedes C-Class (7,017 registrations) and the Volvo XC60 (6,259 registrations). Interestingly, 58% of Volvo’s SUV sales come from its PHEV version, once again highlighting the rise to power of plugins.

Also tellingly, once the ruler of the midsize category in Europe, the BMW 3 Series is nowhere to be found on the podium. And I am not even mentioning Audi’s A4 and A5, because both of them seem to be stuck in a long gone era.

As for the C-segment, Volkswagen Group, its namesake brand in particular, is going strong. Besides having 4 of the top 5 best sellers in the compact plugin vehicle ranking (VW ID.4, VW ID.3, Skoda Enyaq, and Audi Q4), the overall podium in the compact category is 100% Volkswagen. The VW T-Roc led the chart, followed by the VW Tiguan and the VW Golf (yep, it still lives…). This current domination of the category, both in the overall ranking and in the EV table, is no doubt meritworthy, especially considering this is the biggest category in Europe. But…

The remaining categories only saw Volkswagen Group winning a best seller title with the Audi Q8 e-tron (full-size PEVs), losing the rest to the competition in both rankings: the A-segment best sellers were the Fiat 500 (overall) and Dacia Spring (PEV), while in the B-segment, they were the Dacia Sandero and Peugeot 208 EV. In the D-segment, the Tesla Model Y took both titles, while in the E-segment (full size), the BMW 5 Series was the best selling model overall.

Looking at the 2023 ranking, with the Tesla Model Y having three times as many deliveries as the runner-up Volvo XC40, the attention is now focused on the remaining podium positions.

The second placed Volvo XC40 managed to hold onto silver, despite strong results from Volkswagen’s ID EVs that allowed both to surpass the Tesla Model 3 — thus rising to 3rd and 4th, respectively. One of the reasons for that is the 33% delivery YoY drop that the Tesla Model 3 is experiencing this year in Europe, no doubt hurt by the black hole effect of its sibling Model Y. And there are no price cuts that can prevent this from happening again and again, because the Model Y will always be lurking behind the Model 3, stealing potential clients. Europeans prefer the practicality of station wagons or crossovers/SUVs to sedans, and with the Model Y being on average just 5,000 euros more expensive that the Model 3, it’s really a no-brainer. Having said that, the Model 3 can take solace in the fact that due to the Tesla Model Y’s black hole effect, everyone else in the midsize category is also bleeding sales.

Elsewhere, the remaining position changes were the rise of two other MEB-platform models, with the #11 Skoda Enyaq and #18 Cupra Born both climbing one position, something that the BMW i4 also did by climbing from #20 in March to its current #19 position, allowing it to surpass the Hyundai Ioniq 5.

Speaking of Hyundai, the Kona EV rose to #16, with Hyundai’s crossover now making its last celebratory lap before handing over the baton to the new generation.

In the automaker ranking, Tesla is leading with a comfortable 12.6% share, with Volkswagen in the runner-up position with 8.2%, up 0.3% compared to the previous month.

The 3rd spot saw a position change, with BMW (7.7%, up from 7.4%) surpassing Mercedes (7.7%, up 0.1%), but with only 500 units separating both, a lot can still happen between these two.

Finally, Volvo (6.5%) is comfortable in 5th, with #6 Audi (5.4%) at some distance.

Comparing these results with what was happening a year ago, Tesla’s leap is amazing, having added 5.7% to its share. But Volkswagen’s progression is also visible, having increased its share by 2.1%. On the other hand, the biggest loser is BMW, which lost 1.8% in market share, no doubt due to being hit full frontal by the PHEV sales drop.

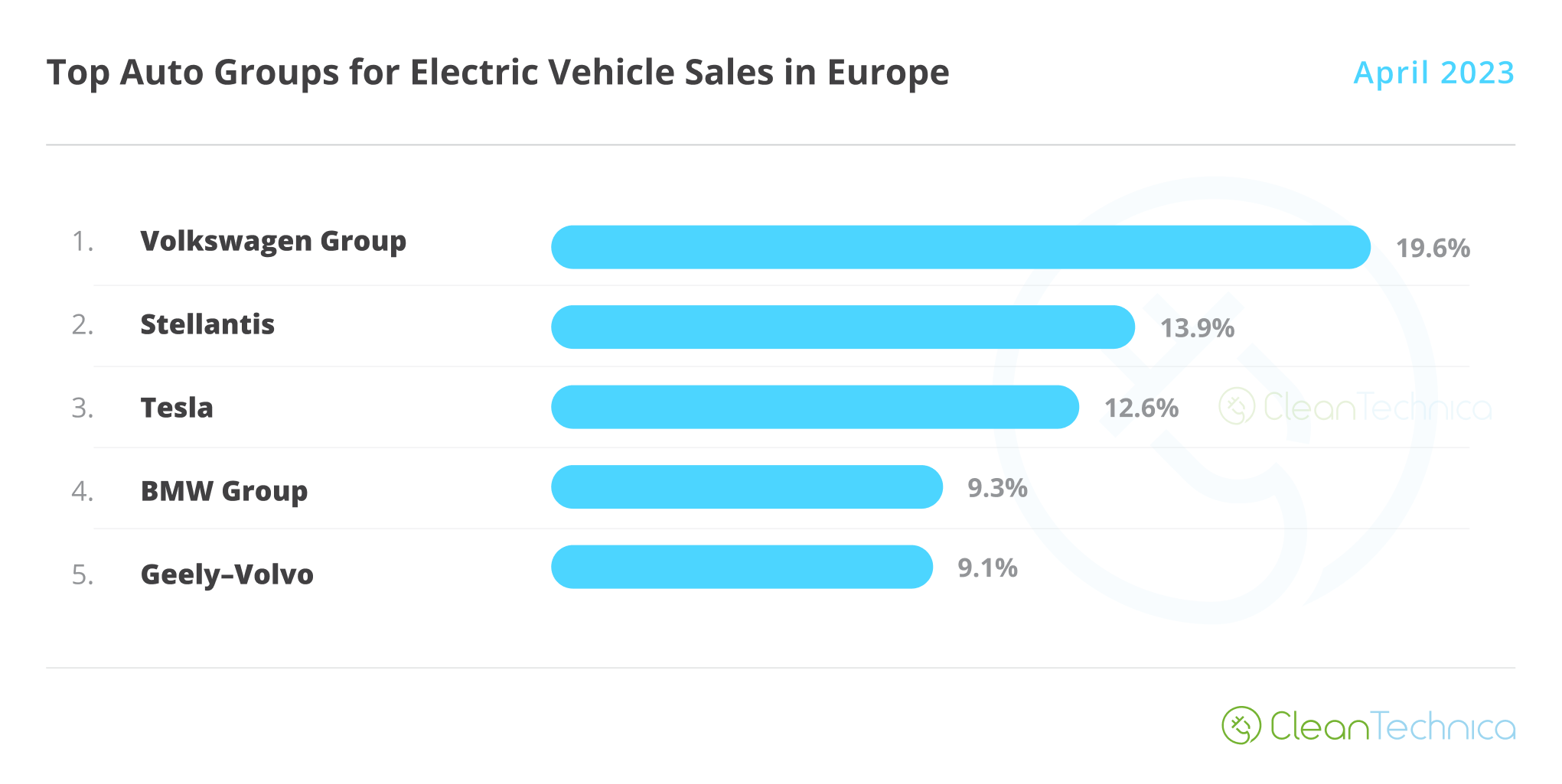

Arranging things by automotive group, Volkswagen Group was up to 19.6%, keeping a comfortable lead over new runner-up Stellantis (13.9%), which surpassed an off-peak Tesla (12.6%). Expect the US automaker to recover the #2 position soon — if not in May, then certainly in June.

The remaining competition recovered share, with the #4 BMW Group going up to 9.3% and the #5 Geely–Volvo up to 9.2%.

With #6 Mercedes Group at some distance (8.6%, up from 8.4%), Geely can still focus on looking ahead and try to recapture #4 BMW Group next month.

Original article: https://cleantechnica.com/2023/05/31/tesla-model-y-rules-supreme-in-europe-europe-ev-sales-report/

@José Pontes, @CleanTechnica