Part of EAFO’s Series on EV Market Trends Across Europe

🔔 Subscribe to our newsletter for the latest updates: Subscribe here

📢 Follow us on LinkedIn for more insights: EAFO LinkedIn

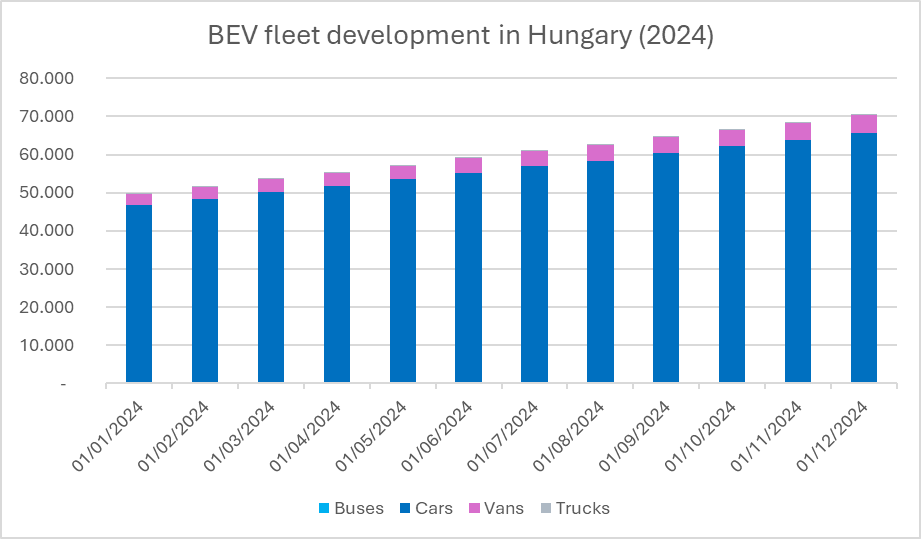

Hungary witnessed a remarkable year for electric mobility in 2024, with the BEV car fleet surpassing 70,000 units. The year closed with a strong performance in December, marking the third-highest monthly registration figure for BEVs ever recorded in the country.

Source: Ministry of Interior

BEV Car Registrations in 2024

According to the Ministry of Energy, nearly 22,000 BEVs received green license plates in Hungary in 2024, setting a new record. Of these, over 20,000 were passenger cars, representing a significant leap from 2023, when just under 14,000 BEVs were registered.

Hungary’s BEV fleet has grown more than ninefold since 2020, illustrating the rapid adoption of clean mobility. This surge was supported in large part by government programs offering subsidies for corporate EV purchases, which have already facilitated over 5,400 acquisitions of passenger cars, vans, and minibuses with more than HUF 21 billion in financial aid.

Popular BEV Models in 2024

Hungary’s BEV market grew by 48%, with 8,565 BEV passenger cars sold, making up 7% of total car sales in 2024.

Top 20 BEV Models of 2024

| Rank | Model | Units Sold | Growth |

|---|---|---|---|

| 1 | Tesla Model Y | 1,163 | +39% |

| 2 | Tesla Model 3 | 808 | +113% |

| 3 | Volvo EX30 | 673 | – |

| 4 | BYD Atto 3 | 569 | – |

| 5 | Nissan Leaf | 377 | +158% |

| 6 | BYD Seal | 355 | – |

| 7 | BYD Dolphin | 314 | – |

| 8 | Hyundai Kona | 292 | +173% |

| 9 | BYD Seal U | 186 | – |

| 10 | BMW iX3 | 177 | -23% |

Source: Datahouse

The Tesla Model Y maintained its dominance, but the Tesla Model 3 saw the most significant growth, doubling its sales following the Highland update. Notably, Volvo’s EX30 achieved a strong third-place position, emphasizing the appeal of well-priced compact SUVs.

BYD demonstrated its growing influence with four models in the top 20—an achievement unmatched by any other manufacturer.

Government Incentives Driving Growth

Government initiatives have played a crucial role in driving the growth of electric mobility. Hungary’s corporate subsidy program offers companies between 6800 - 9700 EUR per vehicle, with applications open until March 2025.

A second program with a 68 million EUR budget focuses on expanding the rural charging network to address white spots and achieve nationwide coverage.

Infrastructure and Emissions

In addition to vehicle growth, Hungary has significantly expanded its charging infrastructure. The network now includes 60,339 charging points, with 31,669 chargers installed across 21,477 locations nationwide. (Source: MEKH, Ministry of Energy)

The adoption of BEVs has contributed to a 7% reduction in transportation-related greenhouse gas emissions in 2023, marking a milestone in Hungary’s efforts to achieve its climate goals.

Looking Ahead

2025 is set to bring even more opportunities for growth. Hungary expects additional launches of affordable EV models, including the Renault 4 and 5, and updated offerings from Stellantis, Tesla, and BYD.

With competitive government incentives and a growing charging network, 2025 may become a breakthrough year for Hungary’s EV market.

Source:

- Ministry of Energy

- Ministry of Interior

- Datahouse

- Villanyautósok

Views and opinions expressed are those of the author(s) and do not reflect those of the European Commission.