Part of EAFO’s Series on EV Market Trends Across Europe

🔔 Subscribe to our newsletter for the latest updates: Subscribe here

📢 Follow us on LinkedIn for more insights: EAFO LinkedIn

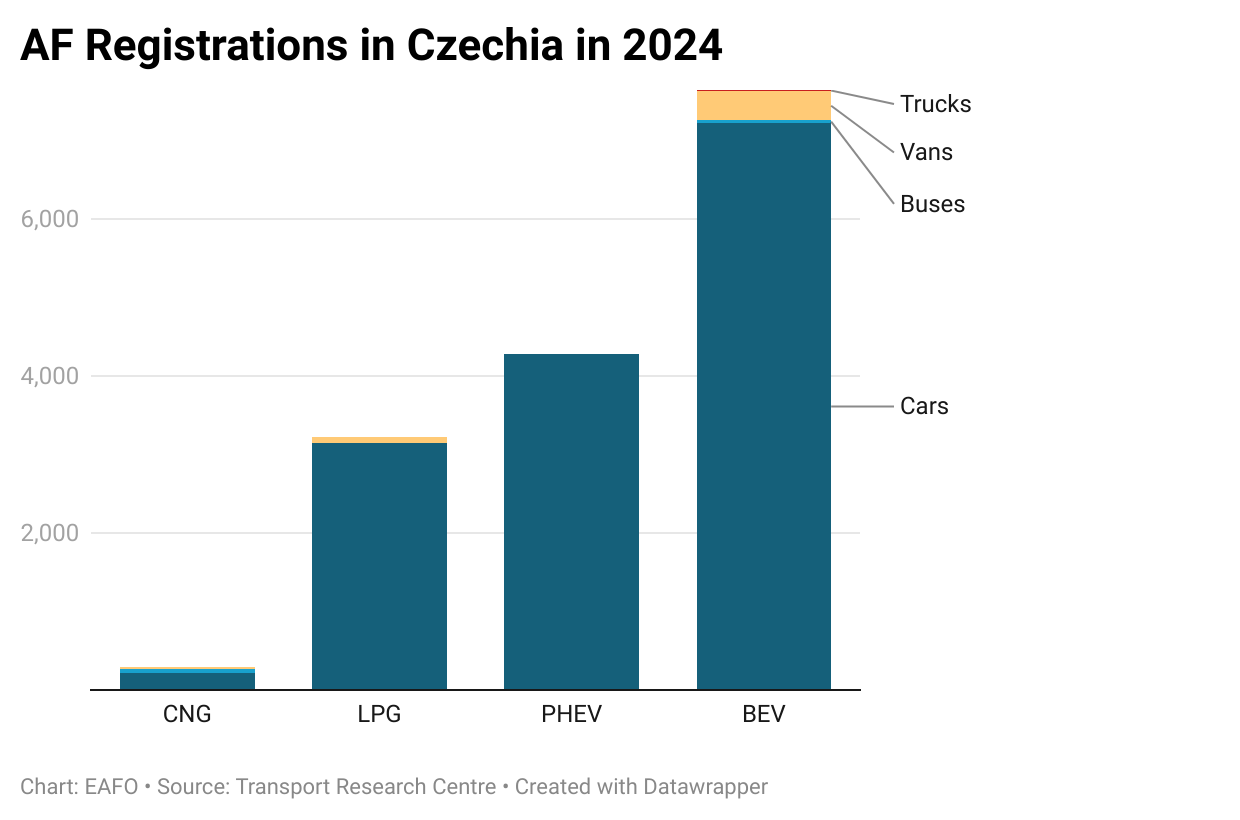

Czechia has experienced unprecedented growth in the popularity of EVs. According to the latest data, the total number of BEV cars on Czech roads surpassed 36,000 at the end of 2024, reaching 36,364 vehicles. This represents an annual increase of approximately 14,000 vehicles, including used cars. The growth, as reported by cistadoprava.cz using Ministry of Transport data, highlights the increasing consumer interest in this sector. Expanding model availability, incentives for zero-emission transport, the development of charging infrastructure, and dispelling misinformation have all contributed to this positive trend.

Key Highlights

Tesla Dominates the Market

Tesla leads the Czech EV market with 8,642 registered vehicles, representing 23.7% of the total BEV segment. Following Tesla, Škoda and Volkswagen are the most frequently registered BEV brands in the country. A dynamic visualization on cistadoprava.cz showcases registration trends by brand from 2010 to 2024.

Secondary Market Boosts Affordability

Used EVs account for approximately 25% of registrations recorded by the Ministry of Transport. The growing secondary market makes EVs more accessible to a broader range of customers. Many buyers now see used EVs as a cost-effective alternative, particularly with innovations in battery technology and the release of affordable new models like the Škoda Elroq, Kia EV3, Renault 5, and Hyundai Inster.

Anticipated Models in 2025

The EV market in Czechia is expected to grow further in 2025 with the introduction of highly anticipated models such as the Tesla Model Y Juniper and the updated Škoda Enyaq.

Regional EV Distribution

Czechia’s 36,364 BEVs represent 0.54% of all registered passenger vehicles in the country. Registration levels vary significantly by region:

| Region | Registered BEVs | Share of Vehicles (%) |

|---|---|---|

| Prague | 12,493 | 1.18 |

| Central Bohemia | 5,386 | 0.60 |

| South Moravia | 3,914 | 0.56 |

| Moravian-Silesian | 2,648 | 0.42 |

| Ústí nad Labem | 1,681 | 0.35 |

| South Bohemia | 1,300 | 0.31 |

| Plzeň Region | 1,306 | 0.32 |

| Olomouc Region | 1,268 | 0.36 |

| Hradec Králové Region | 1,344 | 0.39 |

| Zlín Region | 1,441 | 0.45 |

| Pardubice Region | 1,091 | 0.34 |

| Vysočina Region | 1,054 | 0.34 |

| Liberec Region | 919 | 0.35 |

| Karlovy Vary Region | 519 | 0.29 |

Regional Highlights

- Prague leads the way with 12,493 BEVs, accounting for nearly 1.18% of all vehicles in the region.

- In Brno, the second-highest registration city, 1,925 BEVs were recorded.

- The ORP (municipality) of Mladá Boleslav, home to Škoda, uniquely sees Škoda BEVs dominate with 693 registrations compared to 50 Teslas.

Key Factors for Growth

Government Incentives

The Electromobility Guarantee Program, run by the National Development Bank, significantly boosted EV sales in 2024. This program supported purchases of both new and nearly new EVs.

Evolving Consumer Perception

Educational initiatives, including a series of videos debunking EV myths, have contributed to a more informed consumer base. These efforts are expected to further enhance adoption rates.

Conclusion

The EV market in Czechia is on a strong upward trajectory, with more than 36,000 BEVs now on the roads. As innovations in battery technology and the introduction of affordable models continue, 2025 is expected to bring even greater growth. Targeted incentives and robust infrastructure development will remain key to sustaining this momentum.

Source:

- Transport Research Centre

- Ministry of Transport

Views and opinions expressed are those of the author(s) and do not reflect those of the European Commission.