The European Alternative Fuels Observatory (EAFO) has conducted an analysis of EV recharging infrastructure across Europe for Q1 2024. The data reveals distinct trends and patterns in the distribution and power of EV charging points, highlighting areas of excellence and opportunities for improvement.

Key Trends and Patterns:

- High Recharging Power Clusters:

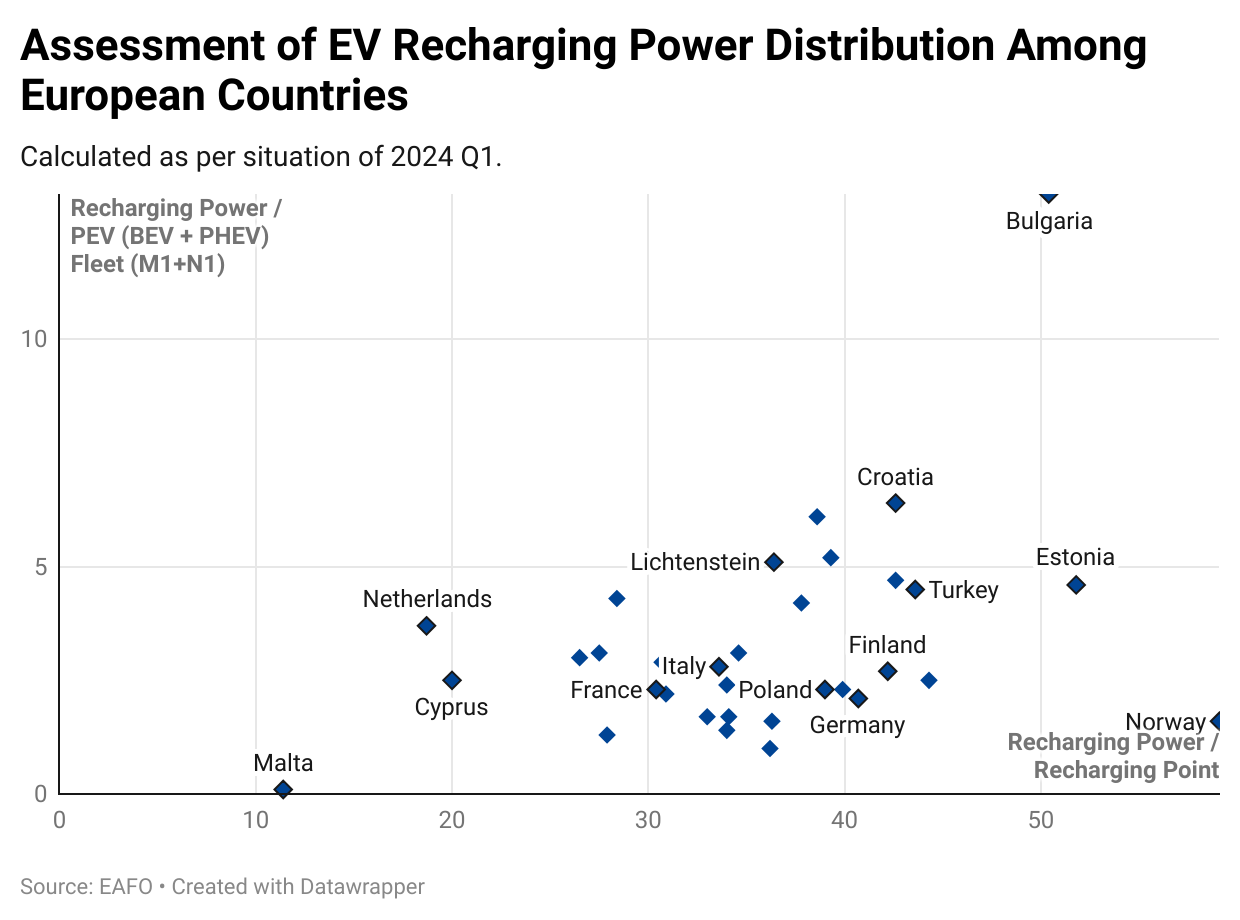

- Eastern Europe Leading in Power per Point: Countries like Bulgaria, Estonia, and Latvia exhibit high recharging power per point, indicating robust infrastructure in relation to the number of charging stations. This trend suggests an efficient allocation of resources where fewer but more powerful charging points are prevalent.

- Central and Eastern Europe: Nations such as Slovakia, Croatia, and the Czech Republic also show significant recharging power per point, forming a cluster of countries investing in high-capacity charging infrastructure.

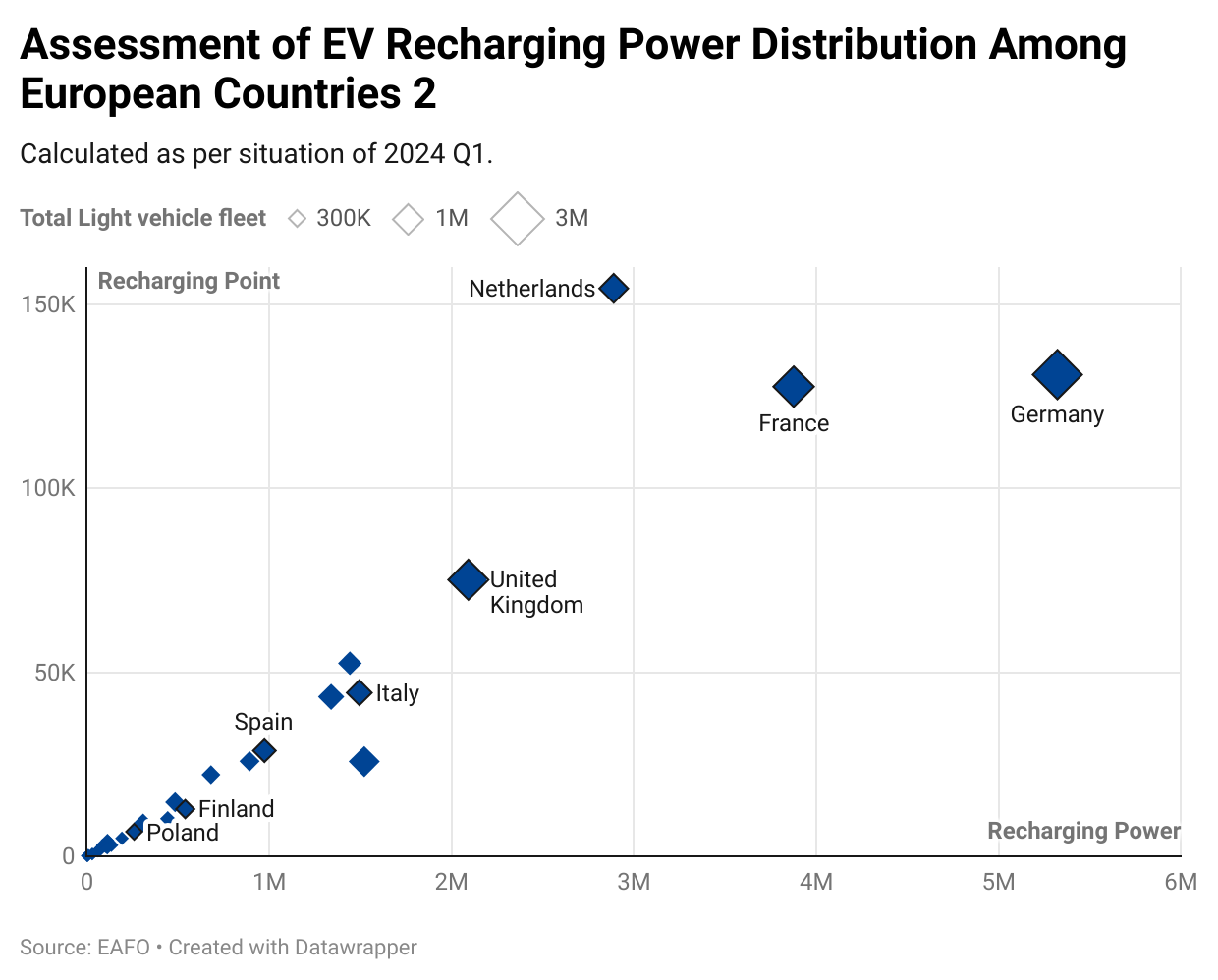

- Balanced Infrastructure in Western Europe:

- Widespread Network but Moderate Power: Western European countries, including the Netherlands, Germany, and France, show a balanced approach with a widespread network of charging points. Although their recharging power per point is moderate, their extensive network supports a large EV fleet, ensuring accessibility and convenience for users.

- Investment in Fast Chargers: These countries also exhibit a notable investment in fast chargers, aiming to enhance the efficiency and reduce the charging time for EV users.

- Emerging Clusters with Growing Infrastructure:

- Southern Europe: Countries like Spain, Italy, and Greece are showing emerging trends in EV infrastructure development. While their recharging power per point is lower compared to Eastern Europe, there is a consistent growth in the number of charging points, indicating ongoing investment and expansion.

- Nordic Region: Norway and Finland, known for high EV adoption rates, are steadily expanding their infrastructure. Although their recharging power per vehicle is lower, the overall growth in charging points signifies efforts to meet increasing demand.

- Need for Accelerated Development:

- Underdeveloped Countries: Ireland, Malta, and Cyprus represent countries with significant potential but currently underdeveloped infrastructure. These regions exhibit low recharging power per vehicle, indicating a pressing need for accelerated investment and development to support future EV adoption.

| Country | Recharging Power / Recharging Point | Recharging Power / Total Light Duty PEV fleet | Total Recharging Power Output (kW) | Recharging Points | Light Duty PEV Fleet |

| Austria | 30,74 | 2,93 | 680332 | 22133 | 232140 |

| Belgium | 27,51 | 3,07 | 1442176 | 52429 | 470303 |

| Bulgaria | 50,44 | 13,17 | 111870 | 2218 | 8495 |

| Croatia | 42,57 | 6,44 | 58655 | 1378 | 9114 |

| Cyprus | 20,03 | 2,51 | 7450 | 372 | 2969 |

| Czech Republic | 39,30 | 5,16 | 192270 | 4892 | 37297 |

| Denmark | 34,60 | 3,05 | 891885 | 25779 | 292196 |

| Estonia | 51,81 | 4,64 | 29014 | 560 | 6248 |

| Finland | 42,18 | 2,68 | 539419 | 12789 | 201018 |

| France | 30,39 | 2,27 | 3875424 | 127530 | 1708826 |

| Germany | 40,68 | 2,05 | 5321694 | 130828 | 2592722 |

| Greece | 26,45 | 2,99 | 112899 | 4268 | 37760 |

| Hungary | 34,13 | 1,67 | 121711 | 3566 | 72965 |

| Iceland | 39,90 | 2,26 | 66945 | 1678 | 29651 |

| Ireland | 36,23 | 0,99 | 108410 | 2992 | 109037 |

| Italy | 33,63 | 2,79 | 1493972 | 44429 | 534981 |

| Latvia | 42,58 | 4,67 | 29718 | 698 | 6361 |

| Lichtenstein | 36,42 | 5,09 | 3861 | 106 | 759 |

| Lithuania | 28,41 | 4,33 | 86567 | 3047 | 19993 |

| Luxembourg | 36,33 | 1,61 | 77494 | 2133 | 48056 |

| Malta | 11,44 | 0,14 | 1155 | 101 | 8107 |

| Netherlands | 18,73 | 3,74 | 2888803 | 154219 | 773155 |

| Norway | 59,15 | 1,63 | 1520741 | 25710 | 932105 |

| Poland | 38,99 | 2,29 | 259216 | 6649 | 113221 |

| Portugal | 33,97 | 1,43 | 308178 | 9071 | 215133 |

| Romania | 44,28 | 2,51 | 134199 | 3031 | 53420 |

| Slovakia | 38,64 | 6,11 | 101824 | 2635 | 16661 |

| Slovenia | 37,79 | 4,16 | 64540 | 1708 | 15500 |

| Spain | 33,98 | 2,38 | 973631 | 28655 | 409677 |

| Sweden | 30,92 | 2,18 | 1339396 | 43313 | 615201 |

| Switzerland | 33,03 | 1,72 | 484023 | 14656 | 281264 |

| Turkey | 43,59 | 4,45 | 443413 | 10172 | 99542 |

| United Kingdom | 27,86 | 1,25 | 2091799 | 75074 | 1667110 |

Strategic Insights:

- High-Power Charging Focus: Eastern European countries demonstrate the effectiveness of focusing on high-power charging points. This strategy can be beneficial for regions with lower overall EV adoption but needing efficient and quick charging solutions.

- Widespread Network Necessity: Western European countries showcase the importance of a widespread charging network to support a larger EV fleet. This approach ensures accessibility and convenience, crucial for encouraging EV adoption.

- Emerging Countries: Southern Europe and the Nordic regions need to continue their investments to catch up with leading countries. The consistent addition of charging points and increasing power capacities will be essential to support the growing EVs on the roads.

- Targeted Investments: Underdeveloped countries like Ireland and Malta require targeted investments to rapidly scale their infrastructure, ensuring they can meet the anticipated growth in EV adoption.

Conclusions

The EAFO’s analysis underscores the varying approaches and stages of development in EV charging infrastructure across Europe. To achieve the EU’s ambitious climate goals, a tailored strategy that considers regional strengths and needs is essential. High-power charging points, widespread networks, and targeted investments will collectively drive the continent towards a sustainable transport future.