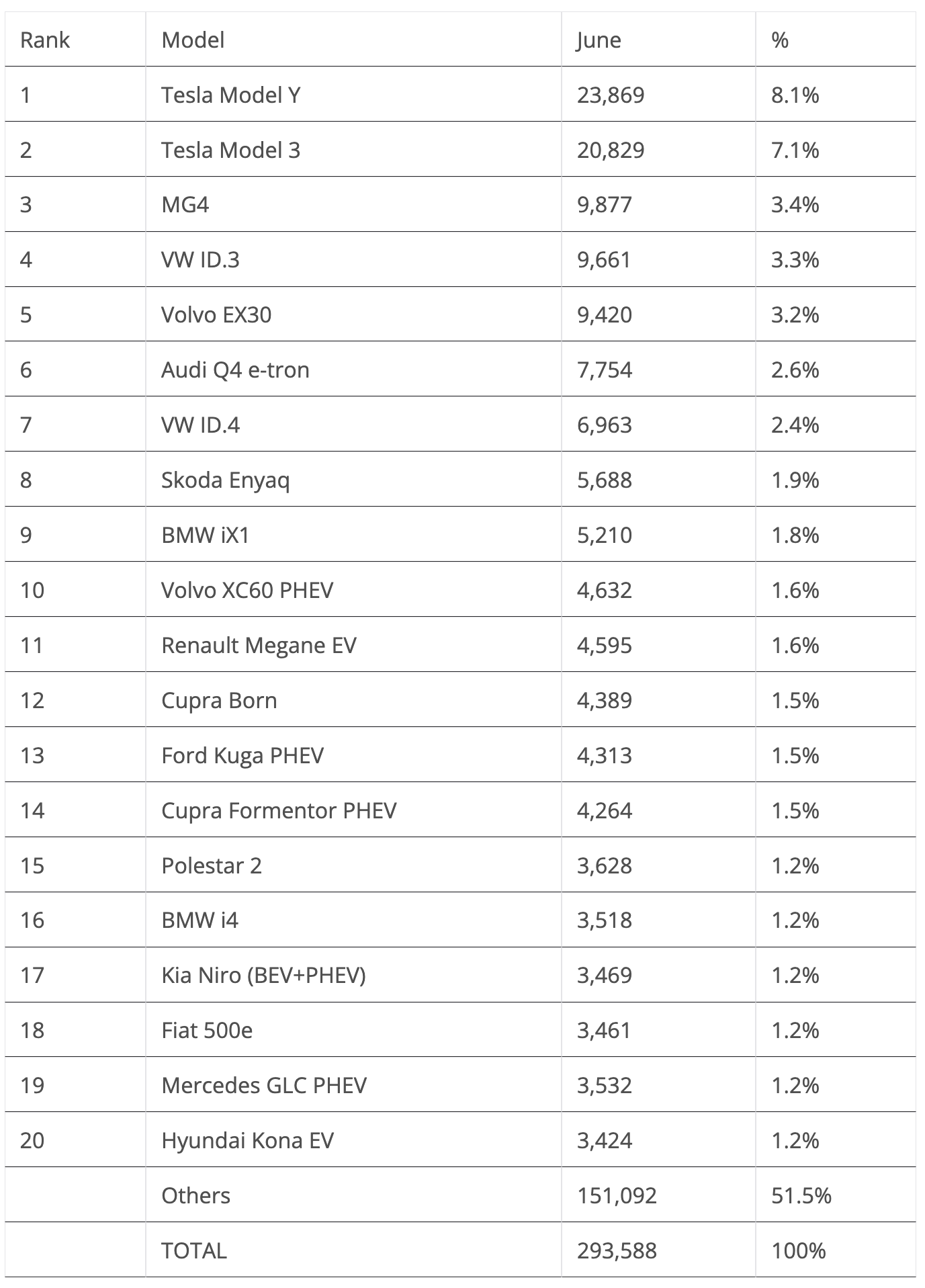

In June 2024, the European electric vehicle (EV) market continued its dynamic journey with 294,000 plugin vehicle registrations. However, the overall market saw a slight decline of 5% year over year (YoY), contrasting with the general automotive market's modest growth of 4% YoY. Within the plugin segment, battery electric vehicles (BEVs) remained stable with no significant growth, while plug-in hybrid electric vehicles (PHEVs) faced a more challenging month, experiencing a 15% drop in registrations.

BEV Market Trends

The BEV market in June was marked by several influential factors. Notably, the market responded to the upcoming changes in import tariffs for Made-in-China (MiC) BEVs, leading to a brief surge in sales. Models like the MG4 and Volvo EX30 saw record-breaking registration numbers as consumers acted swiftly to secure vehicles before the tariff increase.

Despite the overall flat performance in BEV registrations, the market could have seen a 5% growth if Germany’s downturn in BEV sales had been excluded. Germany, Europe’s largest automotive market, experienced an 18% decline in BEV registrations, significantly impacting the overall numbers. This decline is partly attributed to the reduction in subsidies, which has dampened the market's momentum in Germany.

Shifting Powertrain Dynamics

While BEV and PHEV registrations faced challenges, other powertrain technologies, particularly plugless hybrids, saw a strong performance in June, growing by 24% YoY. These hybrids represented 30% of the total market, making them the fastest-growing segment. When combined with the 22% market share of plugin vehicles, over half of the European car market (52%) is now electrified in some form.

On the other hand, traditional internal combustion engine (ICE) vehicles continued their decline. Diesel registrations dropped by 2% YoY, securing only an 11% share of the market, a dramatic decrease from the 50% share diesel vehicles held in 2015. This trend indicates that diesel vehicles are on a rapid decline, potentially phasing out well before the 2035 ICE ban.

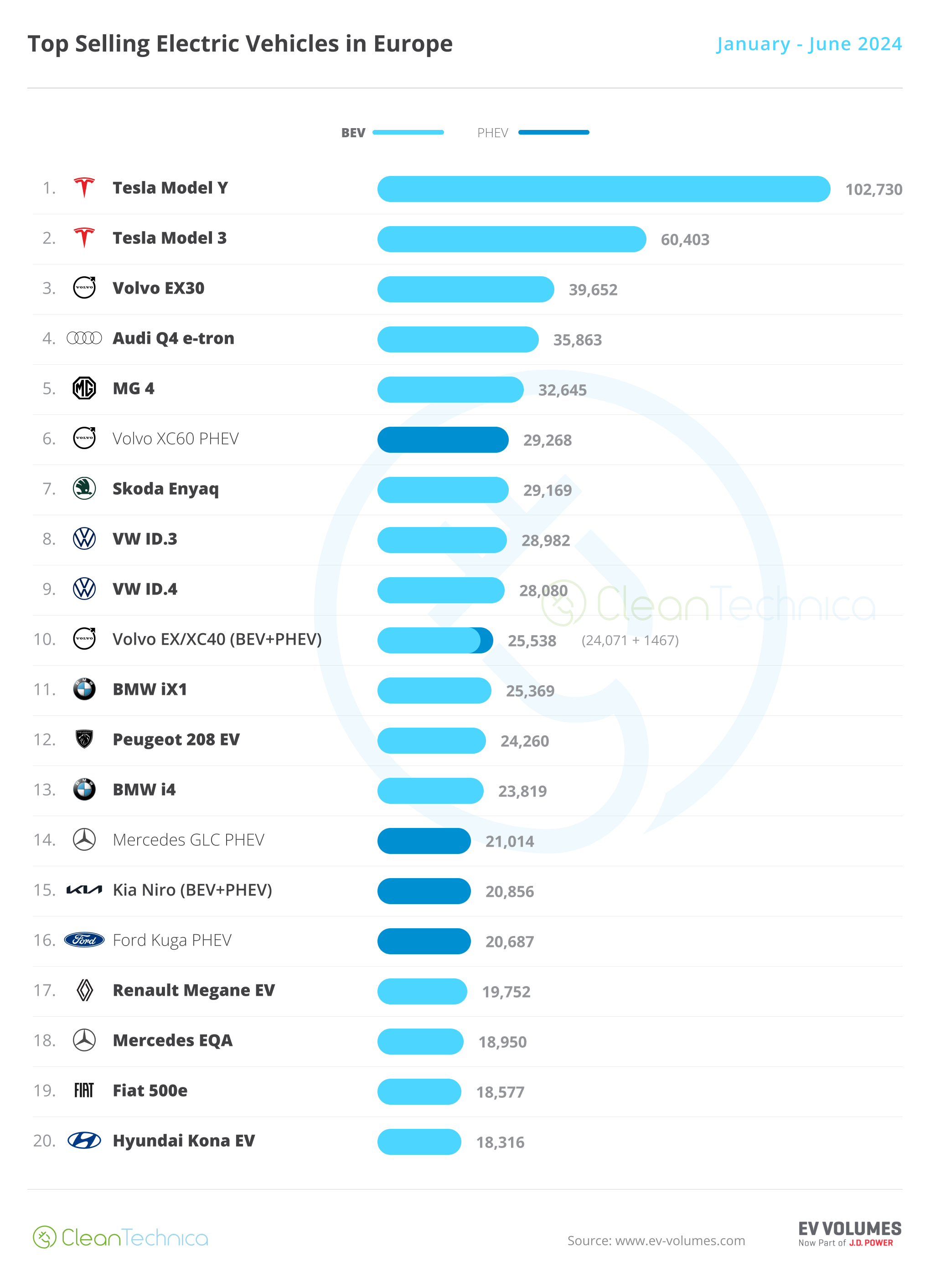

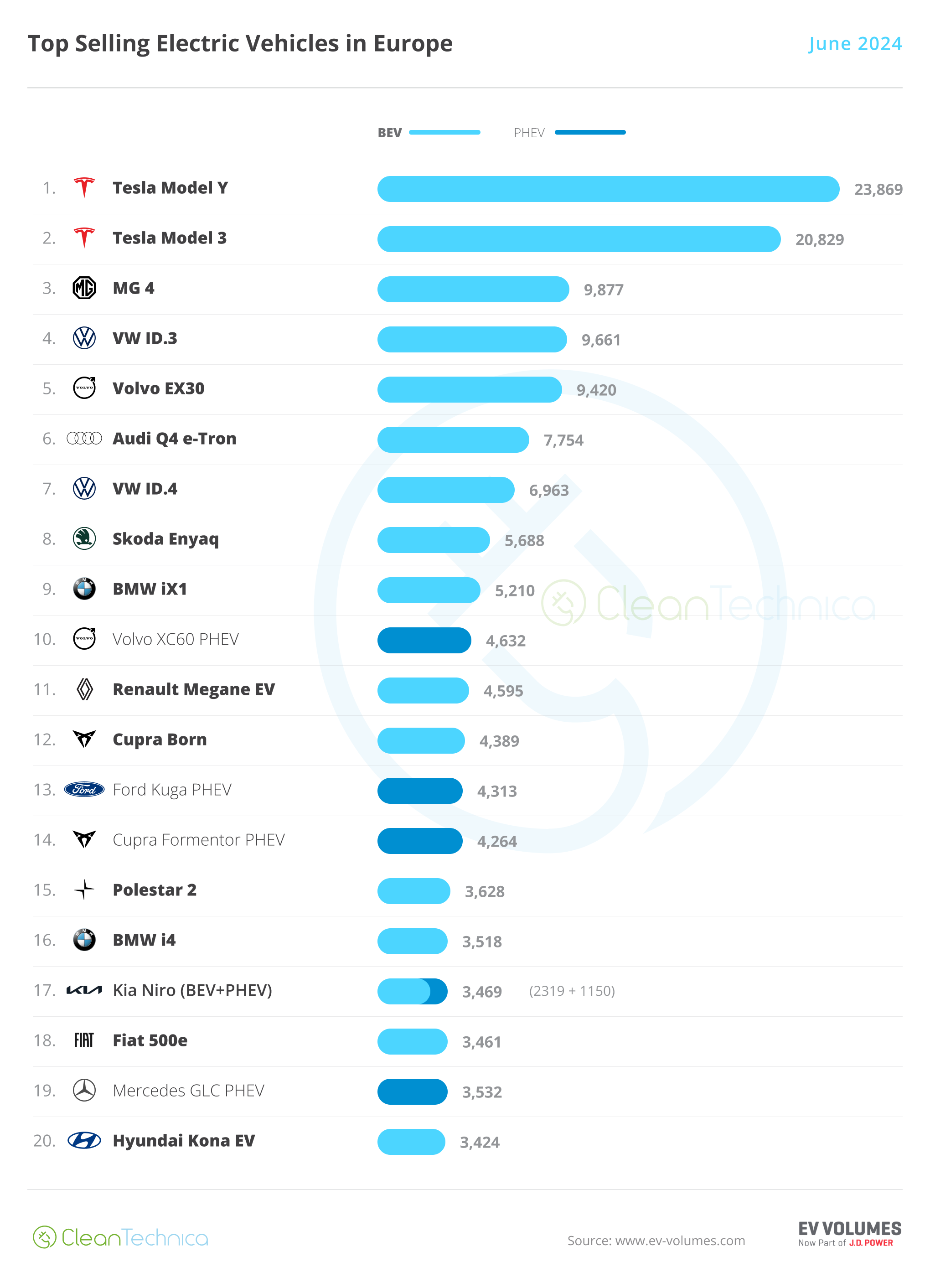

June’s BEV Leaders

- Tesla Model Y: Maintaining its dominant position, the Tesla Model Y was the best-selling EV in Europe with 23,869 registrations, despite a 28% YoY decrease. The Model Y’s significant presence in markets such as the UK, Germany, France, Norway, and Sweden underscores its continued popularity, though new competition is beginning to challenge its dominance.

- Tesla Model 3: The Model 3 had a strong performance in June, with 20,829 registrations, marking its best month since March 2022. The model benefited from the tariff-driven sales surge, particularly in markets like Italy, the UK, and France.

- MG4: The MG4 achieved its best sales performance to date with 9,877 registrations, driven largely by its affordability and solid specifications. Germany, the UK, France, and Norway were key markets for this model.

- Volkswagen ID.3: The ID.3 made a significant comeback with 9,661 registrations, its best in 18 months, thanks to a recent refresh. Germany, where the ID.3 had an exceptionally strong performance, was the primary market driving these numbers.

- Volvo EX30: The Volvo EX30 also reached new heights in June with 9,420 registrations, benefitting from the pre-tariff sales rush. Its balanced distribution across major markets such as Germany, the Netherlands, Norway, and the UK highlights its growing appeal.

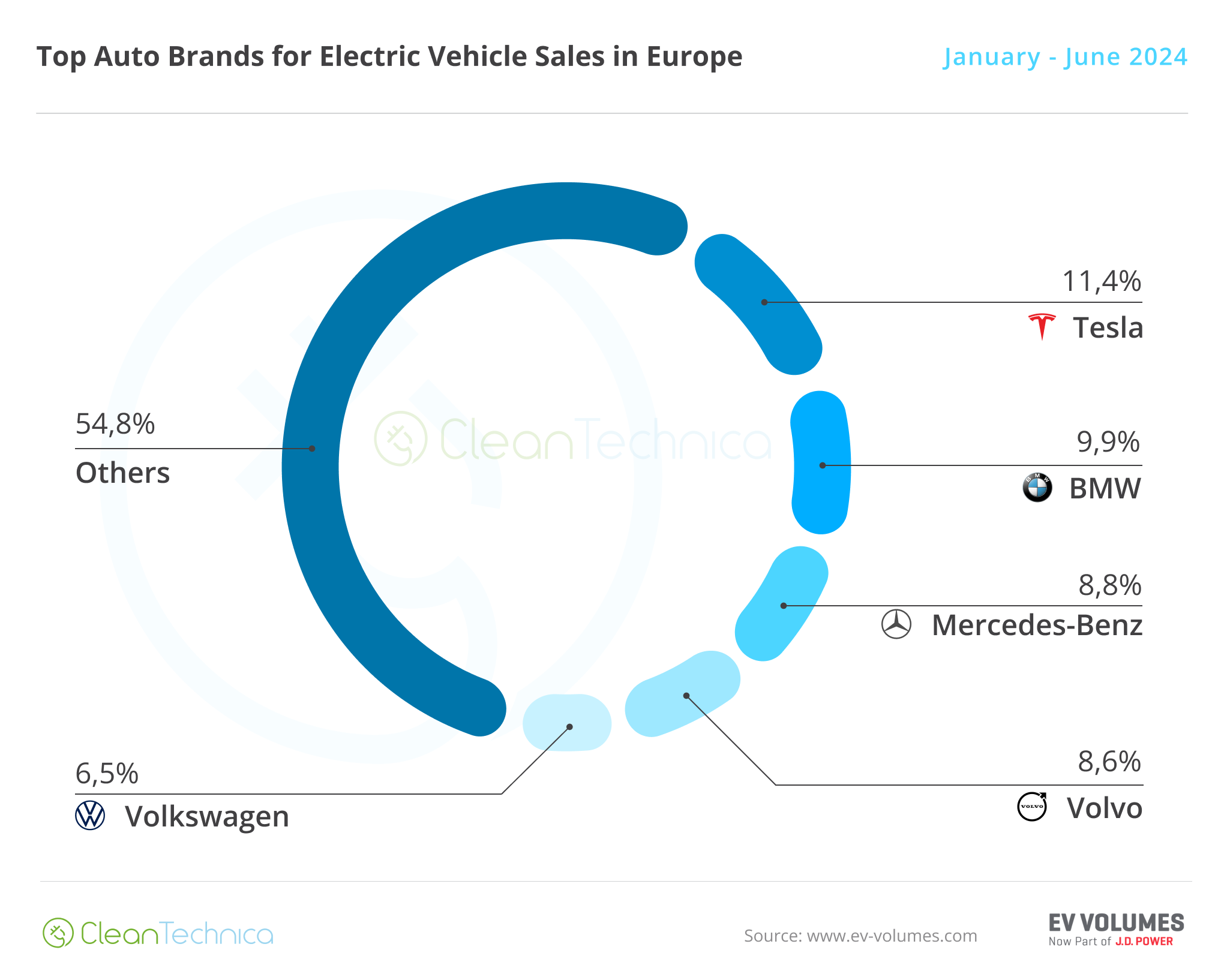

Market Share and Brand Performance

June’s plugin vehicle market share stood at 22%, with BEVs alone accounting for 16%. This result maintained the 2024 plugin vehicle share at 21% (14% for BEVs). Among the leading brands, Tesla continued to secure its leadership position in Europe, despite a slight decline in market share compared to the previous year. Volkswagen Group also showed resilience, with its ID.3 and ID.4 models recovering lost ground and contributing to the group's overall strong performance.

Conclusion

June 2024 was a month of mixed outcomes for the European EV market. While BEVs held steady and certain models experienced significant boosts due to impending tariff changes, the overall market faced challenges, particularly in Germany. As the industry navigates these fluctuations, the broader trend towards electrification remains clear, with more than half of the European market now embracing some form of electrified powertrain. The coming months will be crucial in determining how these dynamics evolve, especially with the ongoing impacts of regulatory changes and market competition.

Source: @José Pontes, @CleanTechnika