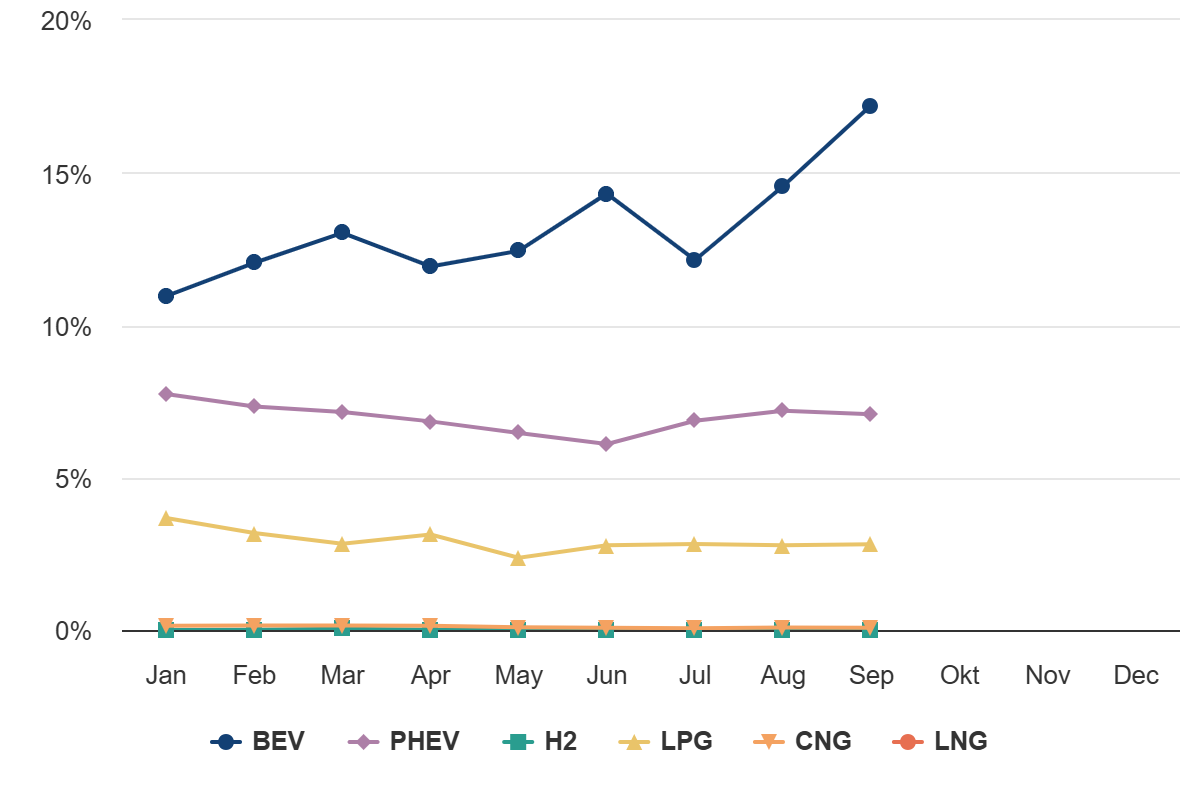

September brought a mix of achievements and challenges to the European electric vehicle (EV) market, with varying performance trends across member states. Looking at the overall market share, the EU closed a record month in September, in 2024 so far, amounting to 17,21% BEV market share, and 7,07% PHEV market share of M1 vehicles. Below, we take a closer look at how individual countries navigated this pivotal month, offering unique perspectives on the region’s electrification journey.

Germany: Stabilizing Amid Challenges

Germany recorded 34,385 BEV sales and 14,843 PHEV sales in September. BEVs achieved a 16.5% market share, while PHEVs accounted for 7.2%.

The Skoda Enyaq emerged as the best-selling BEV in Germany with 3,406 registrations, setting a new monthly record. The Volkswagen ID.7, with 2,673 units, continued to gain traction. While overall EV growth remains tempered by the abrupt end of purchase incentives in late 2023, Germany’s EV market shows resilience, supported by advancements in local manufacturing and a growing charging infrastructure.

United Kingdom: A Leader in BEV Sales

The UK posted 56,378 BEV sales and 24,305 PHEV sales, capturing 20.48% and 8.83% market shares, respectively.

The Tesla Model Y was the standout performer, with 5,780 registrations, making it the country’s most popular BEV. The Model 3 and Volkswagen ID.4 also performed strongly. The UK's robust company car incentives and high consumer demand have cemented its position as a leader in Europe’s EV transition.

France: Strengthening BEV Adoption

France achieved 28,066 BEV registrations and 10,295 PHEV registrations, resulting in 20.19% and 7.41% market shares, respectively.

Despite an overall market contraction, BEVs continued to gain ground, supported by policy measures and social leasing schemes. As France ramps up the production of domestic EV models, further growth is anticipated in the coming months.

Spain: Accelerating BEV Growth

Spain reported 6,396 BEV registrations and 4,062 PHEV registrations, with BEVs capturing an 8.74% market share and PHEVs at 5.55%.

The MOVES incentive program and proactive measures from local automakers have driven this growth. With BEV registrations reaching their highest monthly volume in 2024, Spain demonstrates steady progress toward its electrification goals.

Norway: A Model of Electrification

Norway continues to set the global benchmark for EV adoption. In September, 12,466 BEVs and 145 PHEVs were sold, with BEVs commanding a staggering 96.4% market share.

The Tesla Model Y led with 2,107 registrations, followed by the Model 3 at 2,067 units. Norway's robust policy framework and charging infrastructure keep it on track to meet its 2025 target of 100% zero-emission new car sales.

Netherlands: Solidifying Progress

The Netherlands saw 12,429 BEV registrations and 5,110 PHEV registrations, accounting for 39.79% and 16.36% market shares, respectively.

Tesla dominated the charts with the Model Y (2,585 units) and Model 3 (1,248 units). The country’s consistent investment in public-private partnerships has underpinned the rapid expansion of its charging infrastructure.

Italy: Gradual Growth

Italy recorded 6,212 BEV registrations and 4,049 PHEV registrations, securing 5.1% and 3.33% market shares, respectively.

Despite a volatile market, recent government announcements of multi-year incentive schemes are expected to stabilize EV adoption, helping Italy to sustain its growth trajectory.

Denmark: EVs at the Forefront

In Denmark, 8,926 BEVs and 588 PHEVs were registered in September. BEVs dominated the market with a 61.3% market share, reflecting Denmark's strong commitment to renewable energy and supportive policy frameworks.

Sweden: Mixed Signals

Sweden reported 11,528 BEV registrations and 5,182 PHEV registrations, with BEVs accounting for nearly 45% of the market. Despite this, the overall EV market declined by 8% year-on-year, highlighting economic pressures and reduced consumer spending.

However, Sweden’s charging infrastructure continues to expand, with 617 new charging points added in September alone, providing a strong foundation for future growth.

Austria and Czechia: Regional Highlights

Austria achieved a 22% BEV share of new car sales, while the Czech Republic saw a 56.2% increase in BEV registrations. Both countries demonstrated robust momentum despite their smaller market sizes, driven by strategic incentives and growing infrastructure.

Looking Ahead

September showcased the diverse trajectories of EV adoption across Europe. While some countries faced headwinds, others demonstrated robust growth fueled by policy support, new model introductions, and infrastructure development. This month’s results underscore the importance of tailored strategies to address unique market challenges and opportunities in Europe’s electrification journey.