We start this new stage of EV market coverage by looking at a Southern Europe market, in this case Spain. The EV markets on this part of the continent have been somewhat outside the media spotlight, especially compared to other markets in the northern part of Europe.

With these markets having different characteristics compared to those in the north — not only regarding price, but also type of vehicles, brand preferences, etc. — expect some surprises.

Regarding Spain, while not as advanced as neighboring Portugal, whose plugin vehicle (PEV) market is currently at around 30% share of the overall market, Spain cannot be considered a laggard either — at least compared to Italy, which is still lingering at around 6% share…. With Greece also hovering at around 10% share, one could say that Spain sits somewhere in the middle of the pack when it comes to Southern Europe.

Spain has incentives for plugin vehicles up to €45,000, called Moves, which in this case include not only BEVs but also PHEVs, something that impacts the shape of the market, as we will see below. Since some regional incentives can be added to the national subsidy, that can go up to €7,000.

Looking at the numbers, the overall market was down in March to 94,840 units, a 5% drop YoY, which represented the market’s first drop in 14 months. Though, the year-to-date numbers were still positive, at 244,879 units, representing a 3% growth rate. So, long story short: one can say that the overall market is stable.

Breaking down the overall market by powertrains, one can see that while diesel is falling off a cliff, having dropped 38% in March to 9% share (so let’s give it just three or four more years of life in the new car market), plugless hybrids are booming, having jumped 18% in March. In the context of a falling market, they thus reached 36% share of the total market in that same month.

Although, this impressive result in Spain has more to do with the local tax system, where plugless hybrids, including mild hybrids(!), are considered “eco,” thus getting access to some perks that regular diesel and petrol units don’t — namely, travelling in Low Emission Zones. This helps to explain their popularity in Spain.

As for plugins, PHEVs are more popular than BEVs, with plugin hybrids having 58% of the plugin market this year — 15,700 units vs. 11,386 BEVs. This result can be explained by the fact that PHEVs have almost the same degree of incentives as BEVs, and also by the fact that the charging infrastructure is still patchy in many places. (Although, I can attest that it is much much better now, than what it was a couple of years ago).

This means that the 2024 plugin share is currently at 11% (4.7% BEV), with March having seen a small dip to 10% (4.4% BEV) as both BEVs (4,203 units, -3% YoY) and PHEVs (5,559 units, -7% YoY) followed the overall market trend and dropped slightly.

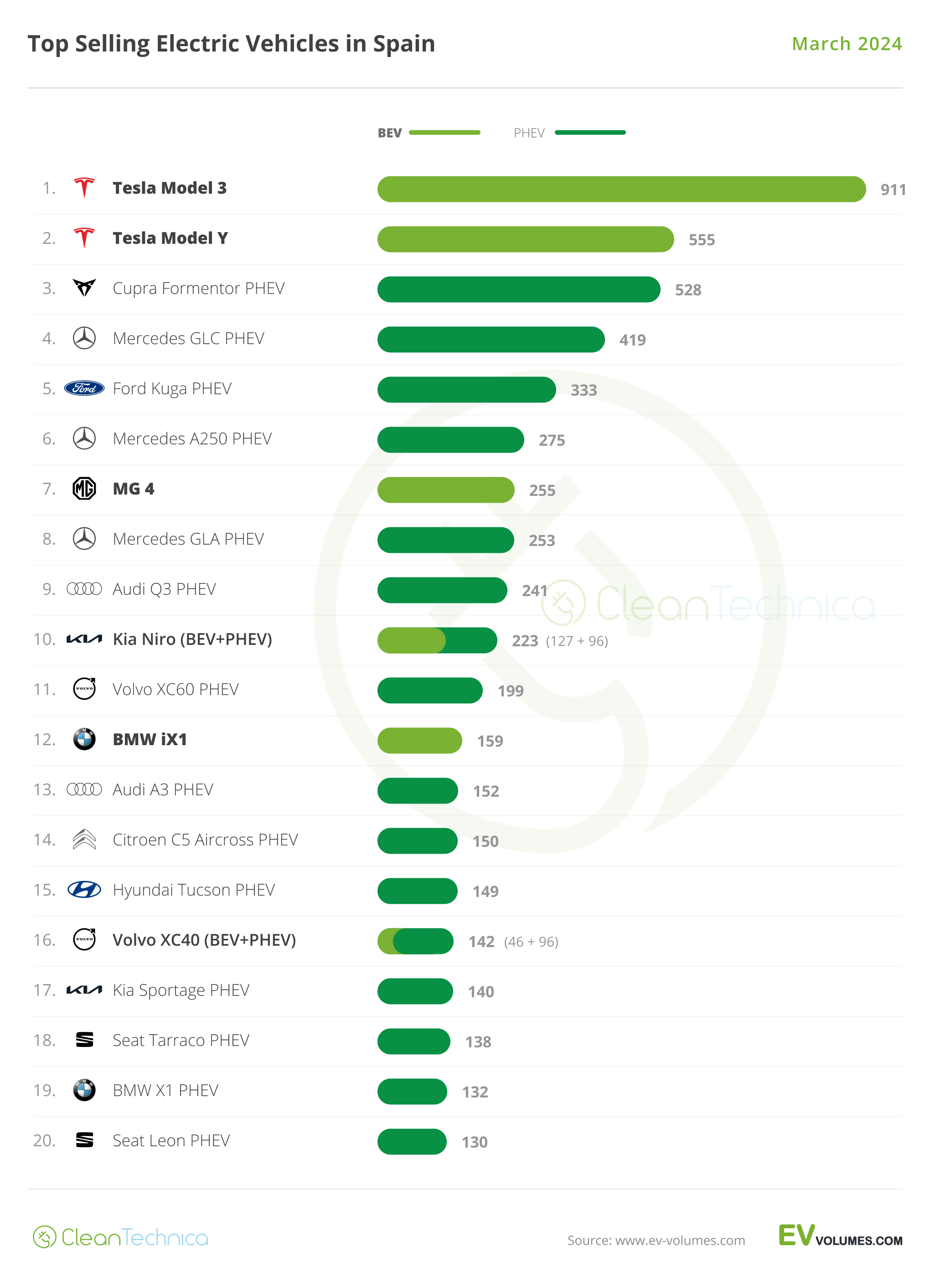

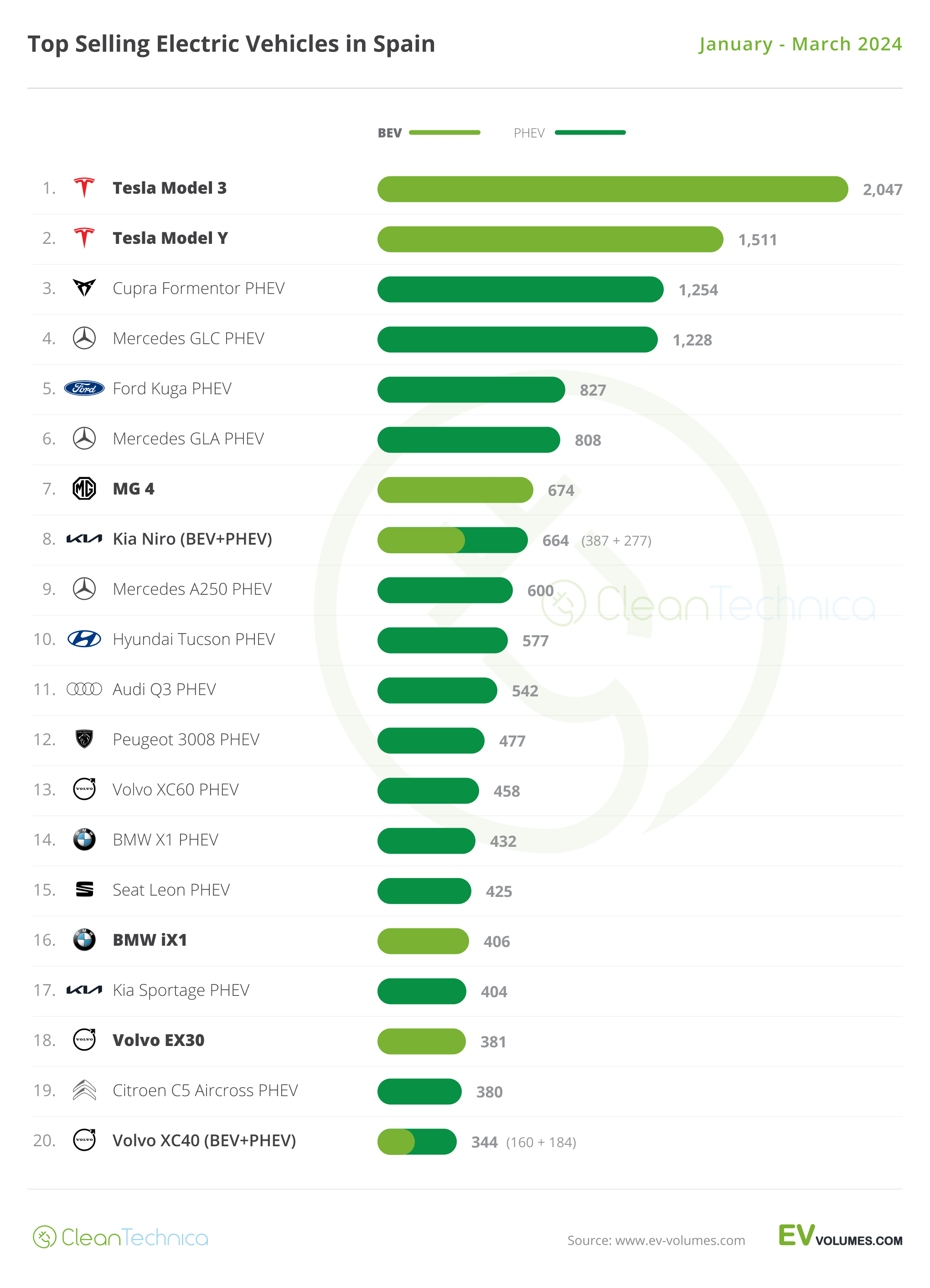

Looking at the best selling models, the situation is that Tesla is at the top followed by a sea of plugin hybrids and a few compact BEVs. Again, charging infrastructure has much to do with this, as Tesla has undoubtedly the best coverage in the country. With many (most?) Superchargers still locked in to Teslas, non-Tesla BEVs are still destined to be “commuter vehicles.”

As such, the Tesla Model 3 is in the lead, some 500 units ahead of the Tesla Model Y, with this being one of the interesting quirks of the Spanish market — as it is one of the few markets in Western Europe where sedans are still popular. Add that to the fact that the Model 3 recently had a refresh and the fact that it is some €5,000 cheaper than its crossover sibling, and you have the recipe for the Model 3 beating the Model Y.

Below the Teslas, the last place on the podium goes to the local hero Cupra Formentor PHEV, which scored its best result ever in March, 528 registrations, allowing the sporty crossover to displace the Mercedes GLC PHEV from the last place on the podium.

Speaking of Mercedes, the three-pointed-star’s PHEVs are quite popular in Spain, with the German make having three representatives in the top 10 — the GLC in 4th, the smaller GLA in 6th, and the A-Class compact model in 9th. That last one scored 275 registrations in March, its best result since December 2022.

Focusing on the remaining BEV models on the table, we have the value for money king, the MG4, in 7th, with 674 registrations. That also makes the Sino-British model the 3rd best selling BEV on the table. It is followed by the #16 BMW iX1, confirming the popularity of the compact BMW, while the Volvo EX30 is already showing up on the table, in #18. The good looking Swede (its design kind of reminds one of a Polestar, doesn’t it?…) is surely looking to climb a few more positions in the next few months.

Outside the top 20, a mention also goes out to the popularity of the cheap as chips Dacia Spring (268 units), the Mercedes EQA (296 units), and the Peugeot e-208 EV (247 units).

Looking at the brand ranking, Mercedes benefits from the popularity of its looong lineup, even beating Tesla (14.6% vs. 13.3%). The German make doubled the sales of its arch rival, BMW, which was in 3rd with 7% share. This is one of those markets where the investment that Mercedes made in its plugin hybrid models (bigger batteries, CCS availability…) is paying off, allowing it to distance itself from its German rivals.

In 4th we have Kia, with 5.9% share, with much of it based on PHEV sales — not only from the Sportage PHEV (#17 on the table), but also from the Niro PHEV, which is selling almost as much the BEV version of the crossover.

There is a close race for the 5th position, with Volvo narrowly beating Cupra. Just 6 units separate the two, and both are at 5.7% share. The Swedish brand is basing its sales in several models (#13 XC60, #18 EX30, #20 XC40), while the Spaniard is going all in with the 3rd placed Formentor.

At some distance, we have Audi in 7th, with 4.7% share, and Peugeot in 8th, with 4.6% share.

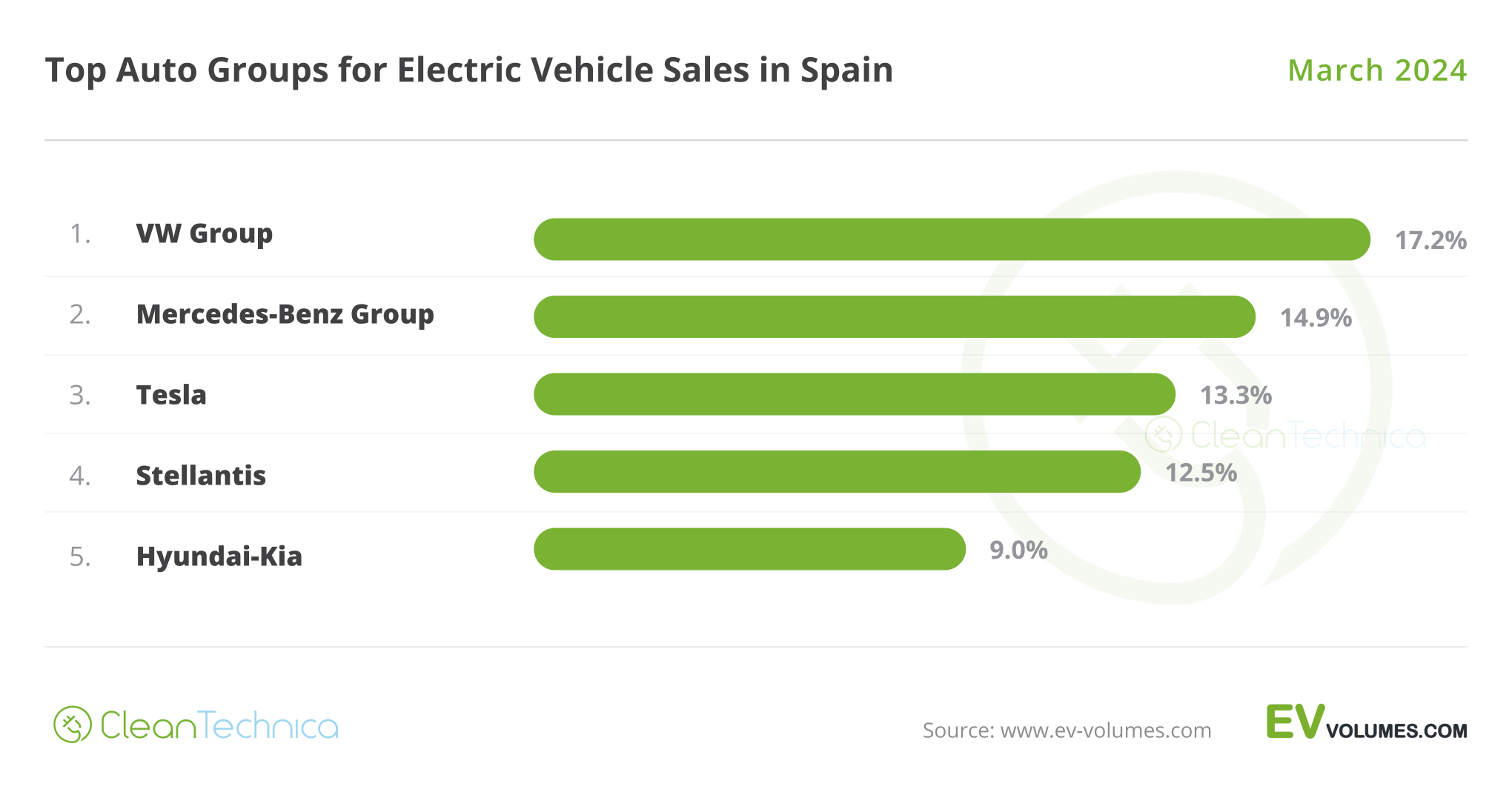

Arranging things by OEM, Volkswagen Group and Stellantis benefited from their long list of brands to place themselves among the best. The German OEM took #1, with 17.2% share, ahead of the Mercedes Group (14.9%) and Tesla (13.3%), while Stellantis was 4th, with 12.5% share, ahead of #5 Hyundai–Kia (9% share). At some distance from the Korean Group, we have #6 BMW Group, with 7.5% share, followed by Geely–Volvo, with 7.4% share.

@JoséPontes, @CleanTechnica

Original article: Link